Over €400 million: New High-Tech Gründerfonds seed fund exceeds expectations

Early-stage financing to support young companies active in the areas of digital tech, industrial tech, life sciences and chemicals

High-Tech Gründerfonds (HTGF) is launching its fourth fund and has already secured a total of over €400 million in commitments at first closing. More than €130 million of this amount will be provided by private investors, who are investing in HTGF’s fourth fund alongside the German Federal Ministry for Economic Affairs and Climate Action, and KfW Capital. The volume of commitments secured has exceeded expectations by far.

from left to right: Dr. Alex von Frankenberg and Guido Schlitzer, Managing Directors of HTGF

High-Tech Gründerfonds

Operating as a public-private partnership, HTGF is ushering in the next generation of successful collaboration between public and private fund investors: Second closing is set to take place before the end of the year, and thus much faster than the previous funds. Forty companies from an extremely wide range of industries are investing in HTGF IV, including medium-sized “Mittelstand” firms in particular, along with numerous major companies and family offices.

The new fund will provide early-stage financing to support young companies active in the areas of digital tech, industrial tech, life sciences and chemicals. The analysis and selection methods employed will be geared even more strongly towards the aspect of sustainability.

"Many private investors were attracted by what we have to offer: access to innovation, returns and impact for our fund investors and society. We’re delighted by the high level of interest we’ve received, and are further expanding our network of innovation drivers in Germany. HTGF has been active for 17 years – we know the positive feedback effects that can boost the innovation capabilities of our fund investors. Together, we will continue to provide initial investment to around 40 innovative tech start-ups each year, and thus make an important contribution to bolstering Germany’s position as a business hub", Dr. Alex von Frankenberg, Managing Director of High-Tech Gründerfonds.

"The high number of forward-looking medium-sized companies, leading corporations and major family offices on board sends out a fantastic signal for entrepreneurs. After providing more than 670 seed investments through our previous three funds, we know the market very well and are aware of just how much potential there is for start-ups here in Germany. We’re pleased to be able to continue financing young tech-driven companies", Guido Schlitzer, Managing Director of High-Tech Gründerfonds.

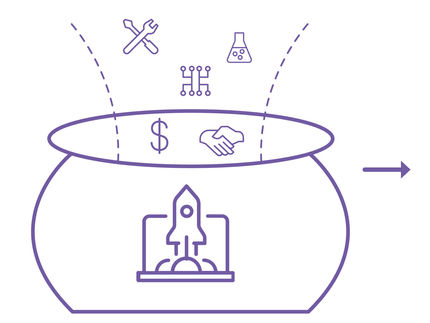

HTGF regards itself as a platform that connects corporations, medium-sized firms and family-run companies with start-ups. Since its foundation in 2005, Europe’s most active seed investor has provided financing for over 670 high-tech start-ups. HTGF has successfully sold more than 150 companies, including a billion-euro exit and four IPOs. HTGF’s funds have attracted investment from corporate investors from the very beginning. HTGF III currently comprises investments from 33 industrial corporations and medium-sized companies, with the number of private investors in Fund IV rising to 40. HTGF III had a volume of €319.5 million after second closing, while the volume of Fund IV is now increasing to over €400 million.

Most read news

Organizations

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Something is happening in the chemical industry ...

This is what true pioneering spirit looks like: Plenty of innovative start-ups are bringing fresh ideas, lifeblood and entrepreneurial spirit to change tomorrow's world for the better. Immerse yourself in the world of these young companies and take the opportunity to get in touch with the founders.