Akzo Nobel intends to IPO Pharma

Akzo Nobel to create two independent companies: Coatings/Chemicals and Pharmaceuticals

"Over recent years, we have made significant progress related to our strategy of fixing pharma, refocusing our chemicals portfolio and continuing to grow and invest in our coatings business," said Hans Wijers, CEO of Akzo Nobel. "As a logical next step, and after a thorough strategic review, we believe that creating two independent companies, Coatings/Chemicals and Pharmaceuticals, will enhance shareholder value through both increased management and strategic focus, and greater transparency. Both businesses are strongly positioned to grow independently."

"The increased management and strategic focus afforded through the separation of Pharmaceuticals will enable us to accelerate growth and invest in attractive expansion opportunities in our Coatings and Chemicals businesses," emphasized Hans Wijers.

The new Pharmaceuticals business will include Organon and Intervet, and will be renamed Organon Biosciences. "The future of Organon Biosciences is strong," said Toon Wilderbeek, Akzo Nobel's Board of Management member responsible for Pharmaceuticals and designated CEO of the new company. "The business is at a turning point and positioned to deliver strong, profitable growth. Our pipeline continues to progress and our strategy for seeking co-development and co-promotion partnerships provides incremental expertise for our business."

After careful consideration, management believes the appropriate first step in creating two independent companies is a minority listing of Organon Biosciences through an IPO on Euronext Amsterdam. Post IPO, Akzo Nobel intends to separate the Pharmaceutical business fully within 2-3 years. Management believes this staged process best meets Akzo Nobel's long-term objectives and will create greater value for shareholders. The final timing will be dependent on important developments within Organon's pipeline which are expected in the second half of 2006, including Phase III data for asenapine, as well as on market conditions. Further information will be provided later in the year.

The definitive decision on the separation of the two companies is subject to approval by an (extraordinary) meeting of shareholders and consultation with relevant employee representative bodies. Akzo Nobel has engaged Morgan Stanley and ABN AMRO as financial advisors on these matters.

Most read news

Other news from the department business & finance

These products might interest you

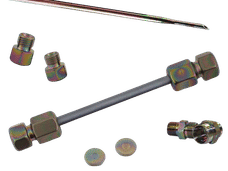

Dursan by SilcoTek

Innovative coating revolutionizes LC analysis

Stainless steel components with the performance of PEEK - inert, robust and cost-effective

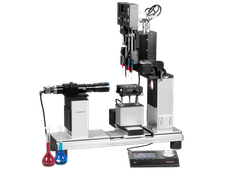

OCA 200 by DataPhysics

Using contact angle meter to comprehensively characterise wetting behaviour, solids, and liquids

With its intuitive software and as a modular system, the OCA 200 answers to all customers’ needs

Tailor-made products for specific applications by IPC Process Center

Granulates and pellets - we develop and manufacture the perfect solution for you

Agglomeration of powders, pelletising of powders and fluids, coating with melts and polymers

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.