API Companies Look for Solutions to Problems of Overcapacity

Lack of Capability Differentiation and Competition from Low-cost Manufacturers

Advertisement

Manufacturers in the crowded and highly fragmented European active pharmaceutical ingredients (API) market are struggling to overcome a variety of challenges. One of the most pressing of these is the problem of overcapacity. Additionally, constant price erosions and the large number of participants present in the market combine to create other challenges such as a lack of capability differentiation.

New analysis from Frost & Sullivan reveals that the total European API market generated revenues of about USD 4.50 billion in 2003. This is projected to increase at a compound annual growth rate (CAGR) of 3.8 per cent to reach USD 5.85 billion in 2010.

While the innovative segment is forecast to experience slow growth, the market for API in generics is on the upswing, driven by a combination of factors such as the ageing population, growth of chronic therapies, cost constraints on social security systems, patent expiries and a thinning pharmaceutical drug pipeline.

The reduced outsourcing of API manufacturing - due to a lack of new drugs and the unforeseen failures of several late-stage drugs - has created a huge overcapacity in the market. This overcapacity is also due to the fact that many current Good Manufacturing Practice (cGMP) manufacturers had made extensive investments in anticipation of strong growth in the custom manufacturing business.

In the absence of steady business from pharmaceutical customers, companies are now exploring fresh opportunities in niche segments and in biopharmaceuticals. Good growth opportunities are especially anticipated for smaller suppliers that are technologically sound in niche areas such as high potency APIs.

"Growing demand for new APIs by biopharmaceutical companies with innovative drug mechanisms provide opportunities for API manufacturers," remarks Frost & Sullivan Research Analyst Himanshu Parmar. "Encouraging growth in the biotechnology sector indicates a promising future for APIs."

Biopharmaceuticals, which currently constitute around eight per cent of the world drug market, are gaining increasing importance and experiencing double-digit growth rates. This can only spell good news for the API market. Again, the ongoing development of novel drugs and a rapidly ageing population will ensure continued demand for innovative APIs and positively impact market growth.

Despite these encouraging factors, problems such as capability differentiation continue to challenge manufacturers to find ways to achieve some kind of distinction in the highly competitive API market. Production capabilities and technology portfolios that are on par with each other creates a difficult situation for manufacturers in Europe.

Manufacturers will therefore have to maintain strong customer relationships to ensure a steady stream of business from them. Enhancing production capabilities as well as improving service portfolios is essential for sustainable competitive advantage. Given the growing number of mergers and acquisitions in the API market, this is also likely to strengthen manufacturers' relationships with the newly consolidated companies and encourage more outsourcing by them.

"Suppliers need to perform a comprehensive revaluation of their technology and service portfolios to gain market presence," notes Mr. Parmar. "An integrated approach with speedy delivery and cost competitiveness needs to be implemented for efficient API manufacturing and considerable profit margins."

One of the biggest challenges facing manufacturers, however, is the growing competition posed by low-cost manufacturers in Asia. Asian manufacturers are able to offer cost-effectiveness as well as meet regulatory standards. In particular, India is emerging as an attractive choice for API outsourcing due to low development costs, complex synthesis capabilities, cGMP compliance and a large domestic market.

"Although current capabilities allow Asian manufacturers to target only the generic sector, they are expected to win pharmaceutical customers in the Western world as they develop greater manufacturing capacity," says Mr. Parmar. "This trend is already being seen in large pharmaceutical companies sourcing an increasing number of advanced intermediates from Asia."

In Europe, the United Kingdom, Germany, France and Switzerland are the major bases for API manufacturers for the innovative sector. Italy and Spain are showing growth potential in the generic sector; in fact, Italy has become one of the major bases for generic API manufacturers due to its advantageous patent regime.

Other news from the department business & finance

Most read news

More news from our other portals

See the theme worlds for related content

Topic world Synthesis

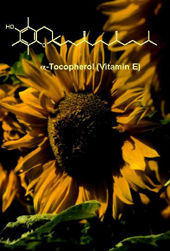

Chemical synthesis is at the heart of modern chemistry and enables the targeted production of molecules with specific properties. By combining starting materials in defined reaction conditions, chemists can create a wide range of compounds, from simple molecules to complex active ingredients.

Topic world Synthesis

Chemical synthesis is at the heart of modern chemistry and enables the targeted production of molecules with specific properties. By combining starting materials in defined reaction conditions, chemists can create a wide range of compounds, from simple molecules to complex active ingredients.