Graphene Set to Make Waves in Multiple Markets Due to its Innovative Capabilities and High Performance

Strong characteristics can put graphene ahead of carbon nanotubes in most application segments, finds Frost & Sullivan

Advertisement

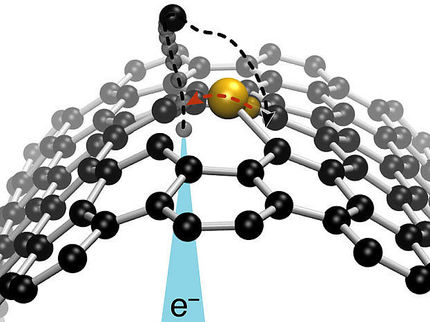

carbon nanotubes and graphene have been competing head-to-head for many of the same applications in recent years. For most applications, the development of carbon nanotubes has been gradually rising as evidenced by patent trends. Nevertheless, graphene has been making drastic progress. In the form of oxides or nanoplatelets, graphene is in a better position to fulfil market needs, as it is a durable, stretchable and lightweight material. New analysis from Frost & Sullivan, Impact Assessment of Graphene in Key Sectors, expects market revenues to reach $149.1 million by 2020.

“The energy sector is one of the prime markets for graphene and will remain so for the next three years,” noted Technical Insights Research Analyst Sanchari Chatterjee. “Lithium storage and catalytic system substrates are some of the most demanding application areas of graphene. However, other applications such as energy storage for batteries and capacitors have also been identified.”

In the electronics sector, graphene is replacing materials like indium tin oxide. While graphene is widely used in flexible electronics, it can further penetrate this sector for the production of minute electronic components and optoelectronics.

In the next three to five years, the adoption of graphene in the electronics and composites sector will increase. Within this time, a number of new markets such as healthcare and personal care are expected to open up for graphene.

However, the absence of large-scale graphene production in a cost-effective and reproducible manner makes commercialisation a major challenge. Till date, graphene has been developed mostly at the laboratory level as processes like nano-slicing used during industrial-scale production boost costs and hamper the quality of end products. Exfoliation processes have been commonly used though.

“Manufacturers are designing several economical and large-scale production processes to ensure that high-quality graphene can be produced within a short time,” pointed out Chatterjee. “This can significantly reduce commercialisation challenges.”

For instance, although graphene is among the thinnest yet strongest materials in the world, its structural design creates flaws when made into sheets for use in energy applications. This compromises performance. Further, the zero band gap of graphene is a major technical drawback as it limits the achievable on-off current ratios.

With the reliability of standalone graphene in doubt, research is on to customise graphene to enable manufacturers to use it in its reinforced and hybrid forms. Overall, corrective R&D and innovative commercialization techniques can help realize the tremendous potential of graphene that ranges from applications in biomedical to anti-corrosion coatings.

Most read news

Organizations

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.