BASF with good earnings in 3rd quarter

Oil production in Libya recommenced in October

The past months have been characterized by large fluctuations and turbulence on the international capital markets which have led to worries about the further economic development. These uncertainties also have affected the economic environment of the third quarter of 2011, in which BASF’s business has developed positively overall. Demand remained at a high level. Compared with the first half of the year, growth slowed further as expected. BASF’s customers planned more cautiously, reduced inventories, and partially delayed orders in expectation of possible falling prices.

BASF expects this trend to continue in the fourth quarter and for the full year expects worldwide growth in GDP, industrial and chemical production to be just under one percentage point lower than the company’s previous forecast. “We are managing our inventories accordingly and are continuing our cost savings programs,” said Dr. Kurt Bock, Chairman of BASF’s Board of Executive Directors in the media telephone conference on the third quarter in Ludwigshafen.

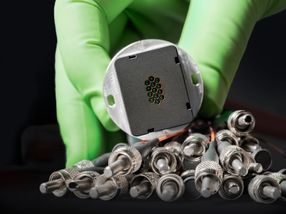

In the middle of October, BASF restarted its oil production in the Libyan desert which had been suspended in February for security reasons after the start of the unrest. Production is currently being ramped up. Initially, a production capacity of 20,000 barrels per day has been achieved. At the moment, it is not possible to say when the maximum daily production capacity of 100,000 barrels of oil will be reached. As soon as enough crude oil has been collected in the fuel storage facilities, it will then be transported via ship. Earnings will only be achieved once this has taken place – probably toward the end of the year.

Despite the suspension of oil production in Libya and negative currency effects, sales increased by 11.6% to €17.6 billion compared with the third quarter of 2010. Income from operations (EBIT) before special items decreased by €249 million to around €2 billion. The third quarter of 2010 included an earnings contribution from oil production in Libya of €355 million, of which €224 million were non-compensable income taxes on oil-producing operations. Excluding this contribution, EBIT before special items was €106 million, or 6%, higher than in the previous third quarter.

Sales volumes in almost all segments were at the same high level as in the third quarter of 2010. In the Oil & Gas segment, production volumes declined substantially due to Libya. Sharply increased raw material costs could be passed on in sales prices in almost all divisions.

BASF grew once again in all regions. In Europe and North America the business acquired from Cognis made a strong contribution. Sales in Asia rose due to price increases as well as good demand in the Catalysts division and in Performance Polymers. Earnings in the Asia region did not match the level of the third quarter of 2010 largely as a result of lower margins in Polyurethanes. In South America, earnings improved thanks to the successful business with crop protection products.

Taking into account the economic risks, Bock stated: “We remain cautious despite the current good performance as economic growth is likely to slow further. In particular, credit restrictions in China, as well as the debt crises in Europe and the United States will adversely impact economic growth. We remain committed to further reducing costs and increasing efficiency. At the same time, we are concentrating on product innovations and the expansion of our business in emerging markets.”

Outlook for full year 2011

The expectations for growth in the global economy in 2011 today are just under one percentage point lower than three months ago (previous assumptions in parentheses):

- Growth of gross domestic product: 2.5% - 3% (3% - 4%)

- Growth in industrial production: 4.5% - 5% (5% - 6%)

- Growth in chemical production (excluding pharmaceuticals): 4.5% - 5% (5% - 6%)

- An average euro/dollar exchange rate of $1.40 per euro

- An average oil price of $110 per barrel in 2011

Despite the overall reduced oil production, the company expects significant sales growth for BASF Group in 2011. BASF expects that the non-compensable income taxes on oil-producing operations reported in EBIT will be around €700 million lower in 2011 (2010: €983 million). Adjusted for the non-compensable income taxes on oil-producing operations, BASF continues to aim to significantly exceed the record 2010 level in EBIT before special items. “We will earn a high premium on our cost of capital once again in 2011,” said Dr. Hans-Ulrich Engel, CFO of BASF SE.

Sales growth in all segments except Oil & Gas

In the Chemicals segment, sales increased in all divisions. Significantly higher sales prices in several business areas contributed to this positive development. Slightly lower volumes overall as well as negative currency effects were more than offset by these price increases. Thanks to improved margins in some areas, earnings also slightly exceeded the level of the third quarter of 2010.

In the Plastics segment, sales rose despite negative currency effects. This was mostly due to sharply increased prices, particularly in the Performance Polymers division. In the Polyurethanes division, earnings were reduced by the decline in the TDI business. Earnings in this segment were below the very good level of the third quarter of 2010.

Sales increased strongly in the Performance Products segment. This development was attributable to the inclusion of the Cognis businesses as well as to higher sales prices. Sales growth was reduced by negative currency effects and a slight decrease in volumes. Earnings grew substantially, also owing to the acquired Cognis businesses.

In the Functional Solutions segment sales also increased compared with the previous third quarter. Negative currency effects were more than offset by higher prices. Demand in the automotive industry for coatings and catalysts remained high. Earnings improved thanks to the strong contribution from the Catalysts division.

In the seasonally slower third quarter, sales in the Agricultural Solutions segment surpassed the good level of the previous third quarter. The very successful start to the season in South America made a significant contribution to this improvement. Increased sales volumes in all regions and higher prices compensated for negative currency effects. Earnings increased substantially.

In the Oil & Gas segment, sales were slightly below the level of the third quarter of 2010 due to lower volumes. The volume decrease in the Exploration & Production business sector was a result of the suspension of oil production in Libya at the end of February 2011. Increased sales prices in natural gas trading and higher crude oil prices could almost fully offset this decline. Earnings improved in the Natural Gas Trading business sector; however, earnings declined overall without the contribution from Libya.