The energy and mobility transition: Sending demand for critical raw materials soaring

Demand for important minerals such as lithium, nickel and copper will be as much as 15 times higher in 2040 than in 2020

The world's industrial base and the global economy are undergoing a fundamental transition away from fossil fuels towards a carbon-neutral future. The shift to clean energy and electric drivetrains in the automotive and transportation sectors is sending the global demand for certain raw materials soaring. In 2040, demand for lithium will be 15 times higher than it was in 2020, and 2.5 times higher for nickel. Likewise for copper, neodymium and other minerals. However, meeting the demand for these critical raw materials is becoming challenging. Supplies of lithium and nickel are expected to only just keep up with global market demand until 2030. Significant planning uncertainties also persist for suppliers and consumers, for instance around predicting future electric vehicle sales volumes. Risks such as supply shortages and a lack of skills in the industry compound the problem. These are the findings of a study for which Roland Berger experts analyzed the global market for critical raw materials and developed solutions for companies affected by it.

Roland Berger

"The main driver of the increasing demand for lithium, nickel and other critical raw materials is the exponential rise in demand for batteries for electric vehicles and energy storage systems," says Wolfgang Bernhart, Partner at Roland Berger. "But solar energy, wind power and electricity network expansion are other areas where certain raw materials and the products refined from them are indispensable."

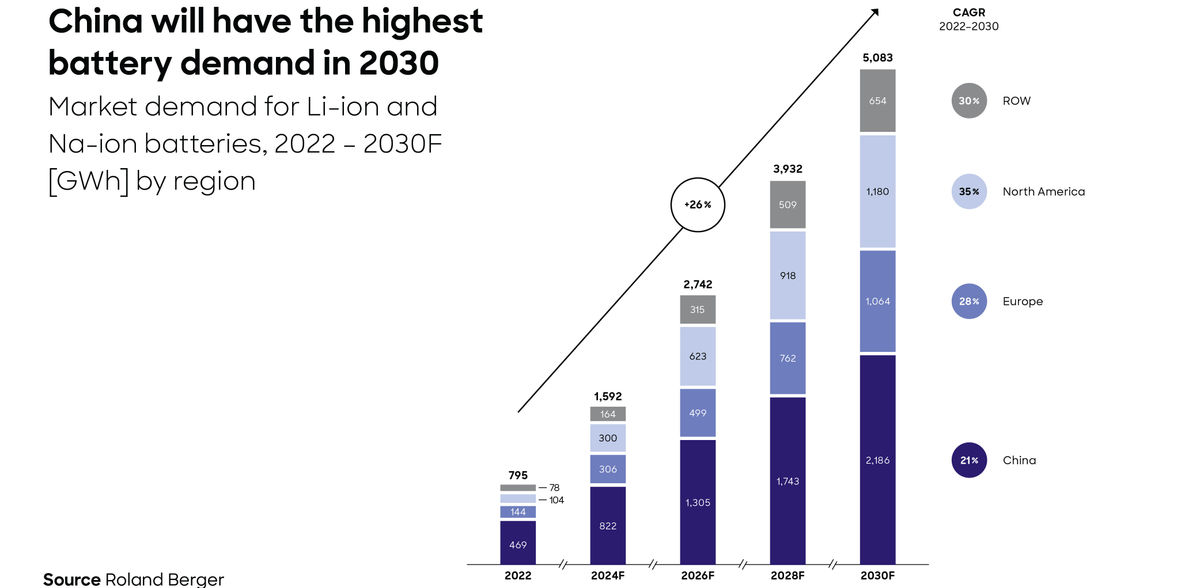

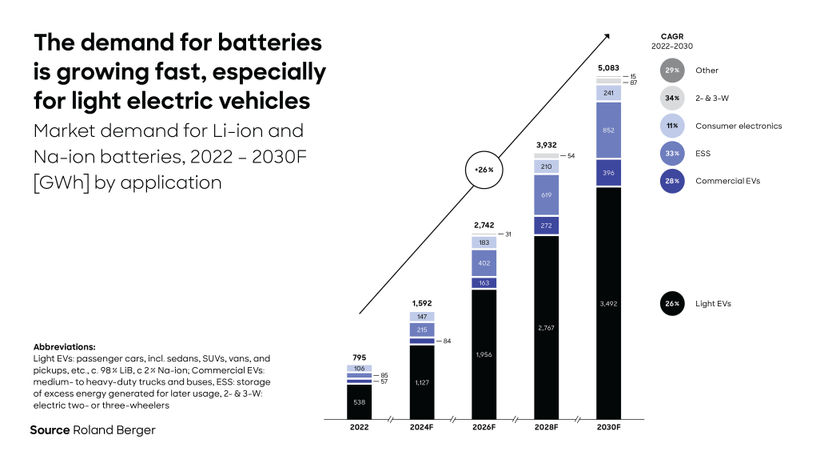

While around 265 gigawatt hours (GWh) of lithium-ion and sodium-ion battery capacity was needed in 2020, demand will hit almost 5,000 GWh by 2030. China is the largest market and electric mobility the sector with the biggest demand.

Fast growing sectors like solar energy, wind power, electricity networks and electric mobility will, according to the International Energy Agency, by 2040, account for almost 90% of lithium demand, 60–70% of nickel and cobalt demand and more than 40% of the demand for copper and rare earth elements.

Resilient supply chains help mitigate risk

In view of the exponentially rising demand, resource availability is becoming a critical issue for manufacturing companies such as battery cell producers and automotive OEMs. According to current capacity plans, mined supplies of lithium, nickel and cobalt are forecast to be sufficient until 2030. But that will require new mining projects, which, depending on the mineral, can take up to 15 years to come on stream.

Given these time frames, uncertainties are especially problematic: Disruptive technologies might fundamentally alter the market, or geopolitical risks could spread and impact supply chains. Just how big an impact individual factors might have can be seen in the forecasts for electric vehicle sales volumes and thus future demand for battery raw materials: Depending on the scenario, estimates for the cumulative level of investments required by 2030 in the mining and refining of lithium, nickel and cobalt and in the production of cathode materials range between 165 and 360 billion US dollars.

"These uncertainties affect every player in the raw material value chain, from mining companies to automotive manufacturers," says Bernhart. "Particularly for cell makers and OEMs, but also for energy technology companies, we would say that they cannot afford not to make their supply chains more resilient if they want to mitigate the risks around critical raw material supplies."

The Roland Berger experts recommend adopting a scenario-based approach, in addition to other tools, to deal with this. That involves building scenarios based on different possible changes in raw material and sales markets, technological evolutions, political trends and other variable factors – right up to black swan events. These scenarios serve as a key basis for decision making, for example on off-take agreements, financial hedging, and also on potential investments in technologies or projects. As Bernhart explains, "The aim must be to secure your supply chain with resilience, making it both stable and flexible enough for you to respond quickly when you need to."

Other news from the department business & finance

These products might interest you

Most read news

More news from our other portals

See the theme worlds for related content

Topic World Battery Technology

The topic world Battery Technology combines relevant knowledge in a unique way. Here you will find everything about suppliers and their products, webinars, white papers, catalogs and brochures.

Topic World Battery Technology

The topic world Battery Technology combines relevant knowledge in a unique way. Here you will find everything about suppliers and their products, webinars, white papers, catalogs and brochures.