Finding the missing piece in global oil life-cycle assessment

New research models the relationship between carbon impacts and market factors in the oil industry

Predicting the behavior of any market is a slippery thing. Energy markets are changing especially quickly, and this is most clearly seen in the oil industry. With decreasing demand during the COVID-19 pandemic and the rise of electric vehicles, the market has experienced a shock, and it probably won’t be the last.

Graphical representation of the Nature paper "Carbon Implications of Marginal Oils from Market-Derived Demand Shocks"

Research Publishing International Ltd

A decreasing reliance on oil for fuel will inevitably decrease the amount of carbon released into the atmosphere throughout the fuel’s lifecycle, from extraction and refining to combustion as it’s used by consumers. However, the size of that impact varies depending on market factors that until now have not been fully modeled.

New research led by Mohammad Masnadi, assistant professor of chemical and petroleum engineering at the University of Pittsburgh Swanson School of Engineering, offers a closer look at the relationship between decreasing demand for oil and a resilient, varied oil market–and the carbon footprint associated with both. The work was published in Nature.

“Previous models have treated oil producers’ carbon footprint as if all barrels of oil are exactly the same, but with novel extraction technologies there is a great deal of variability in the global oil supply,” said Masnadi. “It’s complex, and it’s not linear. Our model takes that into consideration.”

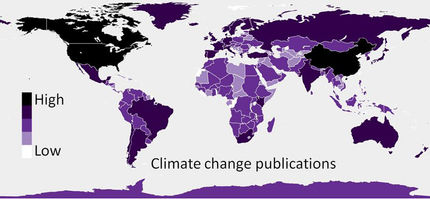

In the paper, the researchers link econometric models of the production profitability of 1,933 global oilfields (representing about 90 percent of the world’s supply in 2015) with their production carbon intensity, a measure of the amount of carbon emitted per unit of energy (or barrel of oil) produced.

They then examined the oilfields’ responses to a decline in demand under three market structures: The first structure models perfect competition between producers, the second assumes there is an oligopoly where several major players drive the most impact, and the third describes a cartel structure that assumes an international entity like OPEC will adjust production to impact oil prices and maximize profits.

Considering these factors, the model predicts that small shocks to demand will have different carbon intensity implications than large shocks, but the relation may be counterintuitive. Regardless of the market structure, small shocks are predicted to displace mostly heavy crudes that have between 25 and 54 percent higher carbon intensity than the global average, knocking down the overall carbon emissions associated with oil. However, the imbalance diminishes as the shocks become bigger–assuming the market structure allows producers with market power to coordinate their response to decreased demand by decreasing production to maintain profits.

The model uncovers an important consideration for government agencies as they create regulations to address climate change: To reduce carbon emissions by reducing demand for oil, policymakers must take into account the global oil market’s structure.

“There’s an assumption that as demand decreases, oil producers who are on the margins will be pushed out of business, but we’ve found that’s not always the case,” said Masnadi. “Everyone knows about these market structures, but by considering it, we show the structure is very important in a global economy. The way the structures play out impacts the kinds of oil fields that will be at the margins and struggling to stay afloat. Even with more penetration of alternative fuels, we might not see many expected players out of business—based on the market structure and their financial situation, many will be resilient enough to adjust their costs and keep producing.”

Masnadi mainly collaborated on this work with economists, engineers, environmental scientists, statisticians, and policy experts from Stanford University and Ca’ Foscari University in Venice, Italy. Together, the team was able to create a realistic model of the effects of changing demand for a fuel that is holding on at the precipice of change.