Merck Looks Ahead to the Future

Merck held its 23rd Annual General Meeting. The company’s 350th anniversary was one of the overriding themes. Stefan Oschmann, CEO and Chairman of the Executive Board, reported to around 1,300 Merck shareholders on business developments and strategic moves in 2017 and presented an outlook for the current year.

“2017 was a good year for Merck. In a challenging market environment, we met all the financial targets that we had set for ourselves. Our ability to do so despite increasing competition in the Liquid Crystals business and the strength of the euro against the U.S. dollar is thanks to the curiosity, energy and engagement of our nearly 53,000 employees,” said Oschmann. “Of course our shareholders are to benefit from the business results of 2017. Therefore, we propose to the Annual General Meeting an increase in the dividend to € 1.25 per share,” said Oschmann.

As already reported, in 2017 Merck generated sales of € 15.3 billion, which corresponds to an increase of 2.0% over the previous year. The strong organic performance of the Healthcare and Life Science business sectors was responsible for this. EBITDA pre, the company’s most important earnings figure, declined by -1.7% to € 4.4 billion. Apart from the difficult foreign exchange environment, the adjustment process in the Liquid Crystals business also contributed to this. Net income rose in 2017 by nearly 60% to a record level of € 2.6 billion. By the end of 2017, Merck had lowered its net financial debt from the Sigma-Aldrich acquisition by nearly 12% to € 10.1 billion.

In the Healthcare business sector, Merck achieved a true breakthrough in 2017 with regulatory approval from the U.S. Food and Drug Administration (FDA) for the cancer medicine Bavencio for the treatment of Merkel cell carcinoma. This is a rare and aggressive form of skin cancer. Further approvals for Bavencio in this indication followed, among others in the European Union. Moreover, Bavencio was approved by the FDA also for the treatment of urothelial carcinoma. Apart from Bavencio, the Biopharma business celebrated a second major success in 2017. In August 2017, Merck received European approval for Mavenclad, a medicine for the treatment of relapsing multiple sclerosis in patients with high disease activity. At the end of 2017, Merck also decided to submit Mavenclad for regulatory approval in the United States this year.

For the Healthcare business sector, 2017 was a year of key strategic moves. In the strategy for its Healthcare business, Merck has stated its clear objective of becoming a global supplier of innovative specialty products. In parallel to the further development of the pipeline, Merck is therefore aligning its business portfolio with this strategy. In August 2017, the Biosimilars business was sold to Fresenius. In September, Merck then announced plans to examine strategic options for its Consumer Health business. On April 19, 2018, Merck signed an agreement to divest Consumer Health to Procter & Gamble (P&G) for around € 3.4 billion in cash. The transaction, which is expected to close by the end of the fourth quarter of 2018, is subject to regulatory approvals and satisfaction of certain other customary closing conditions.

The Life Science business sector, which offers products and solutions for laboratories, as well as for biotech and pharmaceutical companies, again generated very solid growth in 2017. This was driven by all business units, especially however by the business with products for large- and small-molecule drug manufacture. In 2017, Merck received important patents in Life Science. The European Patent Office granted Merck the patent for its CRISPR technology used in a genomic integration method for eukaryotic cells. In the course of the year, Merck received further similar patents from the responsible authorities in Australia, Canada and Singapore. In April 2018, the corresponding patent was also granted in China. CRISPR can be used to understand the link between a gene and the function of that gene in a cell. Making these tools available to scientists helps them to design and carry out experiments to elucidate the cause of diseases – one of the most promising technologies in Life Science.

A highlight for Life Science in 2017 was the opening of the new Life Science Center in Burlington, Massachusetts (USA). This enables Merck to further strengthen its presence in the Greater Boston area, the main biotech hub, and created an attractive working environment, which is highly competitive when it comes to talent and experts. The new facility serves as a regional hub for scientific advances and collaboration with Merck customers.

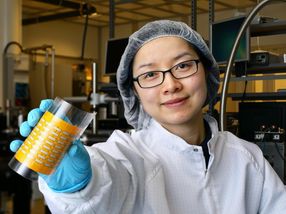

In 2017, the Performance Materials business sector, which offers specialty chemicals and high-tech materials, was again Merck’s most profitable business. Nevertheless, Performance Materials faced growing competition in the Liquid Crystals business, particularly in China. By contrast, the other business units of this business sector showed better performance and, in some cases, generated strong organic growth, for instance the semiconductor materials business. In November, Merck opened a production facility for liquid crystal window modules in Veldhoven, the Netherlands. With an investment of around € 15 million, Merck continues to build on its expertise as the market and technology leader in liquid crystals for displays by moving into other applications beyond televisions, laptops, smartphones, and tablet PCs. In September, Merck debuted with its own exhibition stand at the International Motor Show (IAA) in Frankfurt, Europe’s leading automotive exhibition. The focus of the stand was on high-tech materials from Merck for lighting, antennas, displays and surfaces in the cars of tomorrow.

On September 1, a personnel change took place on the Executive Board, when Kai Beckmann assumed the leadership of the Performance Materials business sector. To strengthen its focus in 2018 even more strongly on the needs of customers and markets, Merck announced in December 2017 that it will combine the expertise of its Performance Materials business sector in three newly created business units aligned with target markets: Display Solutions, Semiconductor Solutions, and Surface Solutions.

Merck uses not only financial indicators to measure its performance. The Corporate Responsibility (CR) Report 2017 shows what responsible actions mean to the company. Merck is focusing its Group-wide sustainability efforts on facilitating access to health among disadvantaged populations in low- and middle-income countries. The Merck Global Health Institute, which was set up in 2017, is working on infectious diseases and antimicrobial resistance. Furthermore, Merck wants to boost diversity within the company. The aim is to further women in leadership positions and to maintain the overall proportion of female leaders at a stable level of 30%, while creating an international working environment and achieving a balanced age structure. With the latest CR Report published this year, Merck is meeting the requirements for a separate, combined non-financial report pursuant to the CSR Directive Implementation Act, which entered into force in 2017. The CR Report also documents progress made in implementing the principles of the United Nations Global Compact.

With a view to 2018, Merck CEO Stefan Oschmann warned about the risks posed by Brexit and the reinvigoration of protectionism. Oschmann also explained the forecast given at the company’s Annual Press Conference on March 8, 2018. In 2018, Merck expects moderate organic growth of Group sales in comparison with 2017. On a currency-adjusted basis, Merck forecasts a slight percentage decline in Group EBITDA pre in 2018 compared with 2017. In addition, foreign exchange rates are expected to impact EBITDA pre by approximately -4% to -6% compared with 2017, which will affect all three business sectors. Merck will provide a quantitative forecast on May 15, 2018 with the publication of its figures for the first quarter of 2018.

Oschmann also gave shareholders his view of the period beyond 2018: “For us at Merck, 2018 is a demanding year. We are investing in our future. These efforts will pay off. As of 2019, we should then generate increases again in all key figures: sales, EBITDA pre and EBITDA pre margin. Because then we expect significant earnings from our new medicines. Our aim is for Life Science to continue to grow faster than the market. All this should more than compensate for the trough that we expect in Performance Materials in 2019.”