Cognis in 2008: stable operating result

Portfolio optimized by divestment of Pulcra Chemicals and Cognis Oleochemicals, resulting in stronger focus on less cyclical growth markets

In 2008 Cognis increased its net external sales by 5.5 percent to 3.001 billion euros. On an organic basis (excluding foreign currency effects and the effects of acquisitions and divestments), sales grew by 9.2 percent.

The operating result (Adjusted EBITDA) slightly fell by 2.6 percent to 351 million euros. This was due to higher raw material and energy costs, as well as unfavorable exchange rates and a decline in volumes which started in the fourth quarter. On an organic basis, the operating result was almost at the same level as 2007 (down by 0.3 percent). Cognis was able to offset its increased raw material costs to a large extent by raising selling prices and by continuing to optimize its cost structures and improve efficiency in all areas.

Return on sales (Adjusted EBITDA as a percentage of sales) was at 11.7 percent. Due to lower restructuring charges, earnings before interest and taxes (EBIT) increased by 5 million euros to 209 million euros. Earnings before tax and special items decreased by 55 million euros to -3 million euros due to non-cash effective revaluation of interest derivatives and US dollar debts. Net loss including special items stood at 63 million euros, representing an improvement of 57 million euros compared to 2007. The net loss of 2007 had been influenced by refinancing costs and the German tax reform. Overall, Cognis’ cash position increased substantially to 226 million euros, mainly due to cash proceeds from the divestments of Cognis’ 50-percent-stake in the Cognis Oleochemicals joint venture, and the sale of its former wholly owned subsidiary Pulcra Chemicals. The company additionally has a revolving credit facility of which 221 million euros were undrawn. Cognis also took advantage of the current conditions in the capital markets. So far, Cognis bought back PIK loans amounting to a face value of 112 million euros in open market transactions, resulting in an improvement of Cognis’ financing costs, net debt and equity.

“The benefits of our wellness and sustainability-driven growth strategy, our improved efficiency and the focus on our core business areas which target less cyclical growth markets are clearly visible and will support our development in 2009,” says Trius, Cognis CEO. “It is difficult to predict what will happen for the rest of the year. One thing that is certain, however, is that Cognis is constantly implementing optimization measures to ensure that it is well prepared for the challenges that lie ahead. To counteract the ongoing weak demand in some of our markets, we recently expanded our cost optimization measures targeting total savings of 70 million euros in 2009. Additionally we expect positive effects of lower energy and transportation prices. We will take the chance to strengthen our position in our key markets during these times of economic uncertainties, by leveraging our customer orientation to develop innovative products which help our customers to gain genuine advantages.”

Organizations

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

Max_Planck_Institute_for_Solid_State_Research

AM404

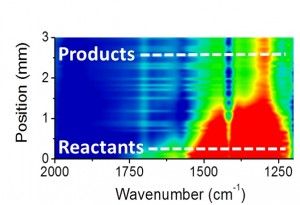

Tracking catalytic reactions in microreactors

Software for the discovery of new crystal structures

Covestro generates strong volume growth in a continuing challenging environment - New circular economy program launched

Arkema Upgrades its Price Increases for High Performance Polyamides

20-hydroxyecdysone

A new way to make sheets of graphene

Pharmacy

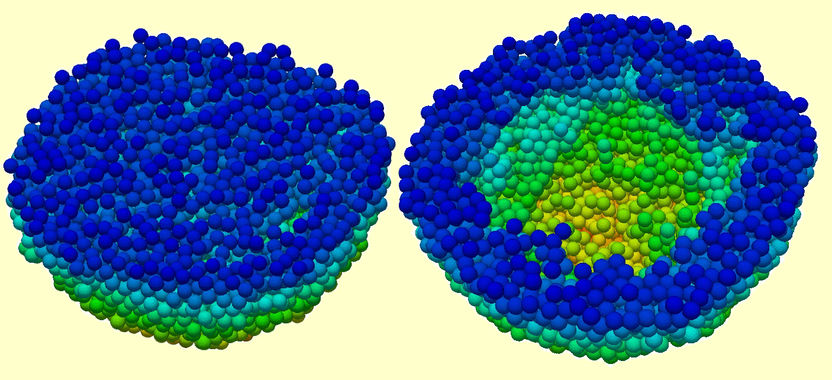

Green hydrogen: A cage structured material transforms into a performant catalyst - Very interesting class of materials for electrocatalysts discovered?

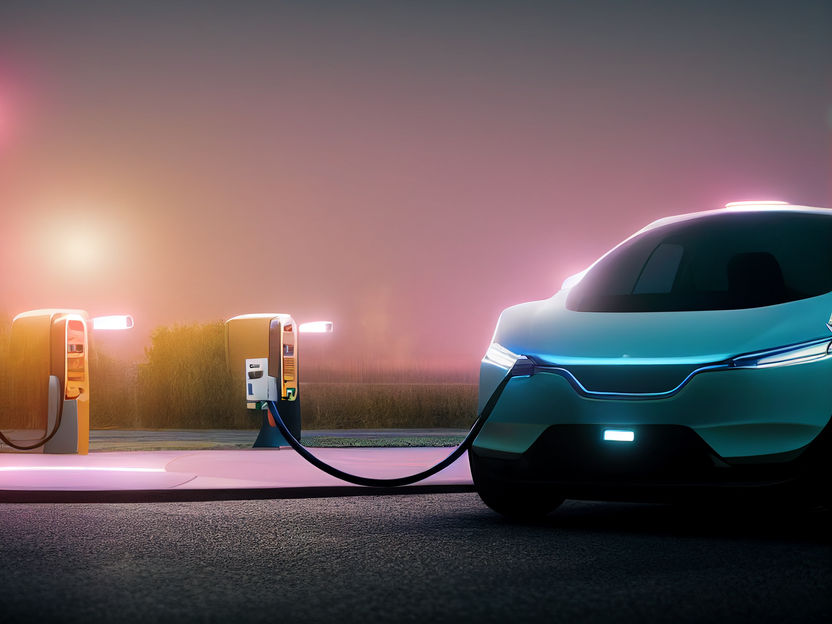

Watching lithium in real time could improve performance of EV battery materials - Researchers tracked the movement of lithium ions inside a promising new battery material