Glass is an energy friendly product, says Commission report, but it faces a lot of challenges

The European Commission has just published a study commissioned by the Enterprise & Industry DG saying that policy makers should consider the environmental and energy benefits of glass when designing new environmental policies.

The study looked at the competitiveness of the glass industry which encompasses a lot of different products: high quality pharmaceutical and cosmetic glass containers, packaging for food and beverages, energy saving glass used in the construction, automotive, composites industries, as well as in electronic and domestic appliances, through reinforcement and insulation fibres, tableware, and special glass for high-tech applications.

The study says the glass industry can improve the image of glass by promoting its products which contribute to huge energy-savings in our society. Low-E windows (coated glass with very good insulating properties), solar control glass (which drastically limits the use of air conditioning), self-cleaning glass (which reduces the maintenance) are such examples as well as insulation products like glass fibres, foam glass, reinforcement glass fibres (for lightweight applications such as windmills, blades, automobiles. Other examples bring together the high quality and safe packaging for pharmaceutical products and the promotion of container glass as a 100% infinitely recyclable product that is pure and natural. All of these elements combine to reduce the need for natural resources, CO2 emissions, energy use, etc.

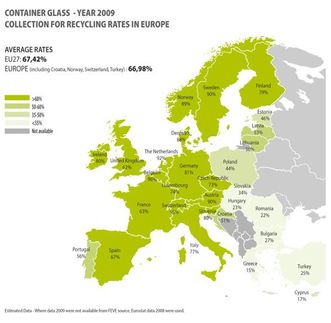

The study shows how environmental advantages of recycling glass may be destroyed if the industry, which is the major buyer of recycled glass, moved production to lower manufacturing cost regions outside of Europe. Glass is also a reusable product and falls perfectly in line with the EU's Waste Framework Directive hierarchy.

The report is timely coming in the midst of discussions on applying a revised EU Emissions Trading Scheme (ETS) to the glass sector which will see the industry’s costs for CO2 rise with the introduction of an auctioning system. With carbon leakage (relocation of production in countries where no carbon-constraint exists) there will be a great loss of innovation and ongoing development of new technologies in the EU. Phase III of the EU ETS will have a major negative impact on the industry - a projection for the UK glass industry forecasts a three to four-fold increase in direct CO2 purchase costs over 2013-20. These burdens, imposed at the production stage, disadvantage glass over substitute materials, whose environmental impacts arise further down the supply chain.

A more level playing field could be achieved by considering the whole life cycle of the product, the report says.

The relatively high energy intensity of glass production makes reducing carbon dioxide emissions a major challenge. The review shows that the technologies used in glass production to minimise energy use are already mature and that short-term future increases in efficiency are likely to be limited. The study acknowledges that manufacturers are close to the physical limits of efficiency due to the laws of thermodynamics and the limitations of modern materials for furnace construction.

Another competitiveness problem that the EU glass industry faces is the relocation of production outside of the EU where environmental regulation in the worst case is non-existent and in many cases less stringent, and where health and safety laws are more relaxed. Relatively high levels of EU regulation have meant that EU glass producers are no longer competing on a level playing field in the global environment and this is handing a competitive advantage in certain markets to non-EU firms.

The report calls for the branding of glass as a energy-friendly product and suggests that policy makers push on to improve recycling, building insulation and the functioning of the EU energy market - promoting competition in energy markets and development of a pan-EU electricity grid.

Original study: FWC Sector Competitiveness Studies – Competitiveness of the Glass Sector within the Framework Contract of Sectoral Competitiveness Studies – ENTR/06/054, Final Report, 14 October 2008.

Organizations

Related link

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

Category:Sulfur_oxoanions

GEA lifted by demand from food process technology

HLA-B61

HTT energy GmbH - Herford, Germany

LANXESS increases prices in three business units

A patent-free playground - Researchers and industrial companies collaborate to create a new Open Science platform