EU chemical industry: Good year 2007, slowdown expected for 2008

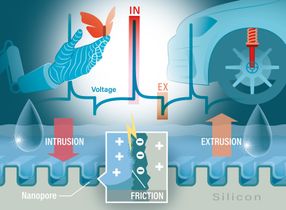

Advertisement

Cefic, the European Chemical Industry Council, expects output in the chemical industry (excluding pharmaceuticals) to grow by 2.6% in 2007, compared to 2.1% in 2006. The 2007 growth figure lies above the average growth rate over the last five years, which is due in part to recovery from technical problems in several petrochemical installations in 2006. The year 2008 may show a slowdown and the business of chemistry may reach a growth rate of 1.9%.

During the first seven months of 2007, output of the chemical industry (excluding pharmaceuticals) rose by 2.7% compared to the same period of the previous year. The chemical business confidence index remained at a high level until losing momentum in October 2007. Accelerated growth in chemicals (excluding pharmaceuticals) is partly based on strong growth rates in industry in general and especially in important chemical downstream user industries, such as automotive or machinery and equipment. All chemicals sectors benefited from a relatively good macroeconomic environment for the EU. Domestic demand remained strong and, despite the weakening of the US dollar, exports continued to grow. However, data show increasing import pressure for some chemicals sub-sectors such as polymers and specialty chemicals.

For the whole of 2007, all segments are expected to show positive growth figures. Consumer chemicals should outperform all other chemicals sub-sectors. Petrochemicals are showing a recovery in 2007 after a very modest year 2006, mainly caused by maintenance and technical problems. Polymers are also recovering from low growth last year, although strong industrial demand is partially satisfied by rising imports. Basic Inorganics are expected to show only moderate growth figures, and are suffering from increasing competitive pressure due, among other things, to high energy prices. Pharmaceuticals will not be able to equal their extraordinary growth performance of 2006, but will still be among the growth leaders in 2007 and 2008. Specialty chemicals will experience slightly slower growth due to lower demand from overall manufacturing industries in Europe.

Looking ahead, Cefic expects an output growth of 2.3% in 2008 for the EU chemical industry as a whole (including pharmaceuticals), moving down from 3% in 2007. The decline in 2008 would be caused by the dampening effects already existing in 2007, but materialising only with some months' delay, and a general cooling down of the world economy.

The prospects for the EU chemical industry are, however, sensitive to a number of serious downside risks. First, the continuing US Dollar weakness against the Euro weighs more and more heavily on the export performance of EU industry. Secondly, continuously high oil prices, though they have apparently so far had only a limited dampening effect on the overall macro-economic environment, will lead to higher production costs and lower consumer and business confidence. Last but not least, the financial crisis in the USA could have a stronger than expected impact on the world economy. Global Economic Environment

After a good year 2007, the world economy is expected to lose some momentum in 2008, but growth should remain fairly robust. Cefic estimates world GDP growth will decrease from 3.5% this year to 3.3% next year. High economic growth, especially in the emerging Asia countries, but also in Eastern Europe and South America, continues to offer interesting trade opportunities for Europe, though the strong euro risks threatening to undermine EU industry competitiveness.