AGREEMENT TO BUY AUSIMONT IS MAJOR THRUST IN SOLVAY'S STRATEGY TO BOOST HIGH-VALUE SPECIALTIES

Solvay has signed today an agreement with Montedison and Longside International aiming at acquiring Ausimont, the fluorinated specialties group. This acquisition would be the largest ever made by Solvay and would significantly upgrade the Group's product portfolio, by doubling the size of its activities in the high-growth, high-added-value fluorinated specialties sector.

After the completion of the transaction, Solvay's fluorinated specialties would generate an annual proforma turnover of approximately EUR 900 million, with 2,700 employees. Solvay would be N°2 worldwide in fluoroproducts.

The proposed transaction is subject to regulatory approval by the relevant authorities. Upon satisfaction of this condition, Solvay would acquire 100% of the capital of Ausimont and 100% of Agora, Ausimont's holding company, for EUR 1.3 billion.

The price reflects the excellent profitability of Ausimont as well as its strong growth. Furthermore, this acquisition implies significant synergies, given the complementarity between the activities of Ausimont and those of Solvay in fluorinated specialties.

Completion of the acquisition is anticipated in the first half of 2002.

The information and consultation process of the workers' representatives is in progress.

Aloïs Michielsen, chairman of Solvay's Executive Committee said: "The planned acquisition of Ausimont is a unique opportunity for Solvay to leap forward in its strategy to build leadership positions in high-value specialty products. Solvay has the expertise and resources to seize this opportunity, which would change the face of the group, improve its competitiveness, boost innovation, enhance profit margins and secure future growth. With this operation, Solvay would become a leading global player in fluorochemicals and fluoropolymers. Also, Ausimont would contribute its outstanding R&D capabilities, which would further enrich Solvay's product portfolio - with products that have an extensive technological content."

Vincenzo Morici, General Manager Solvay's Specialty polymers and performance compounds, indicated: "Ausimont's fluoropolymer products and know-how are ideal complements to our group's high performance polymers, which were already expanded through our deal with BP. Solvay would gain access to crucial expertise in monomers - the building blocks of fluorinated plastics - and upgrade its entire value chain. As well, Ausimont would be contributing two whole new lines of fast-growing fluoro-materials to Solvay's portfolio: fluoroelastomers and fluids."

Eberhard Piepho, General Manager of Solvay's Fluorine Business stressed that "Through this operation, Solvay would significantly enhance its fluoroderivatives portfolio and complement extensively its R&D and sales&marketing. Furthermore, through the integration of Ausimont's activities, Solvay would have a unique fluoride value chain spreading from fluorspar mines in Namibia down to the marketing of sophisticated fluorinated products."

This acquisition would be financed through the Group's available cash and through a structured funding from a third party. The mechanism of this funding would allow the Group to "cash in" in advance the proceeds that would be paid by BP if Solvay were to exercise its put option on its interest in the BP Solvay Polyethylene joint ventures. Under the agreement signed with BP concerning the HDPE joint ventures, the put option gives Solvay the right to sell, at a determined price and at a fixed date, its participation in the European and American Joint ventures.

This structured funding would become effective only upon closing of the Ausimont operation.

As a result, Solvay would fund this acquisition without imposing an excessive burden on its finances - i.e. it would continue to meet its goal not to exceed lastingly a 35% net debt to equity ratio. In 2000, this ratio was 29%.

Most read news

Organizations

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

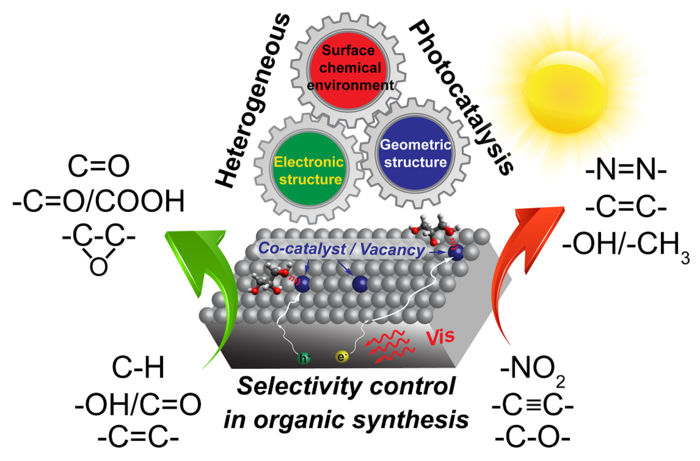

Improve industrial chemical reactions with better products and less byproducts - Heterogeneous photocatalysis can help scientists sustainably control products and byproducts of chemical reactions, including reducing CO₂

Color me purple, or red, or green, or ...

Warming up the world of superconductors - Clusters of aluminum metal atoms become superconductive at surprisingly high temperatures