Bayer: Takeover offer for Schering successful

Bayer now controls 88.0 percent of issued and outstanding Schering shares

The way is now clear for the Bayer Group to acquire Berlin-based pharmaceuticals company Schering AG. Bayer has gained control of a total of 88.0 percent of Schering's approximately 191 million issued and outstanding shares. The attainment of a three-quarters majority was the last remaining condition of the takeover offer. Both the E.U. Commission and the U.S. antitrust authorities had already given their unconditional approval.

By the expiration of the acceptance period on June 14, 2006, 87.3 million Schering shares had been tendered to Bayer under the takeover offer. This is equivalent to 45.7 percent of the issued and outstanding Schering shares. In addition, by the same date, Bayer had acquired 77.8 million Schering shares, or 40.7 percent of the issued and outstanding Schering shares, either on the stock market or directly. The minimum acceptance threshold of 75 percent was therefore exceeded. A further 2.9 million Schering shares, or 1.5 percent, were purchased by the Bayer Group thereafter.

"We're pleased to have received such broad-based support from the stockholders," said Bayer Management Board Chairman Werner Wenning. "We also invite the remaining Schering stockholders to accept our attractive offer of EUR 89 per share," he added, pointing out that the additional acceptance period runs from June 23 until July 6, 2006. Bayer continues to pursue its goal of wholly acquiring Schering.

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

Salla_disease

Global Bioenergies reports first isobutene production from waste biomass

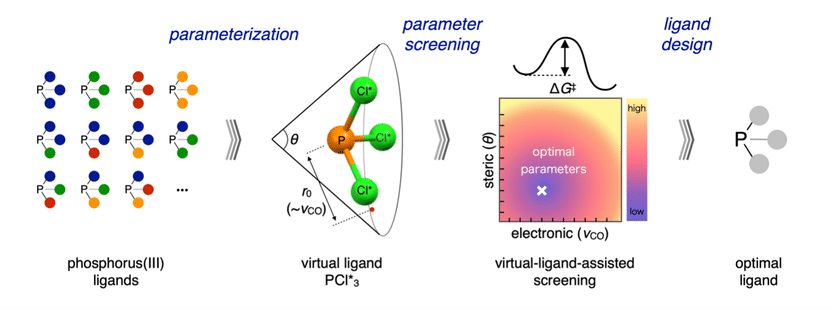

Chemical reaction design goes virtual - Researchers aim to streamline the time- and resource-intensive process of screening ligands during catalyst design by using virtual ligands

Borouge awards contract to Agility (Abu Dhabi) PJSC to build the Borouge Compound Manufacturing Unit and Shanghai Logistics Hub

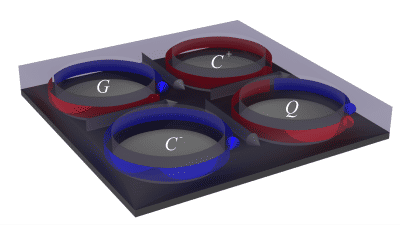

Three magnetic states for each hole

New Innovations Manager at JULABO - Jens Amberg reinforces the management team of the JULABO Labortechnik GmbH as a leading manufacturer of temperature control technology

New active substance against parasites

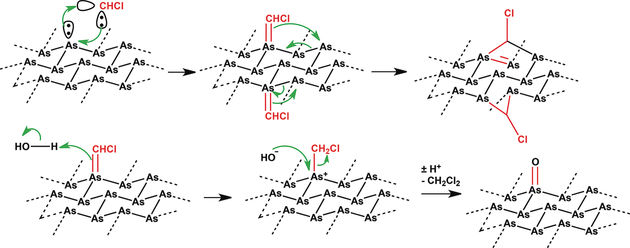

Arsenic for Electronics - Covalently modified two-dimensional arsenic

Eastman Consolidates Coatings Technology Groups

Eppendorf supports the smartLAB project - The special exhibit premiers at LABVOLUTION

BASF builds new plant for alkylethanolamines at Antwerp site - Increase of BASF’s global alkylethanolamines capacity to 140,000 metric tons per year