Bayer amends Schering takeover offer

Acceptance period for Schering stockholders extended by two weeks

Bayer has decided to amend the takeover offer for Schering AG and waive the offer condition in section 6.1.6 of the offer document. As a result of the amendment, the acceptance period is automatically extended until June 14, 2006, 24:00 hours CEST.

"The extension of the acceptance period enables all Schering stockholders to accept our attractive offer within the next two weeks," commented Bayer AG Management Board Chairman Werner Wenning.

The takeover offer continues to be subject to the condition that the minimum acceptance threshold of 75 percent is reached by the end of the acceptance period. The offer price of EUR 86 in cash per Schering share also remains unchanged. The offer is thus approximately 61 percent above the unweighted 12-month average price and some 39 percent above the closing price of Schering shares before the first takeover rumors surfaced.

Bayer published the takeover offer for Schering on April 13, 2006. Since then good progress has been made, including the receipt of unconditional approvals from the E.U. Commission and the U.S. antitrust authorities. Furthermore, the number of Schering shares being tendered for sale has further increased over the past few days. As of Monday, May 29, 2006, 18:00 hours CEST, the acceptance rate was 18.49 percent. In addition, Allianz AG, which holds 11.4 percent of the shares and is thus Schering's largest stockholder, has publicly announced its intention to accept the offer. Bayer is therefore convinced that the acquisition of Schering will be successfully completed.

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

More comfortable and safer: new concept for chemical protective suits

Electronics integrated in plastic becomes more sustainable - Recyclability by Design

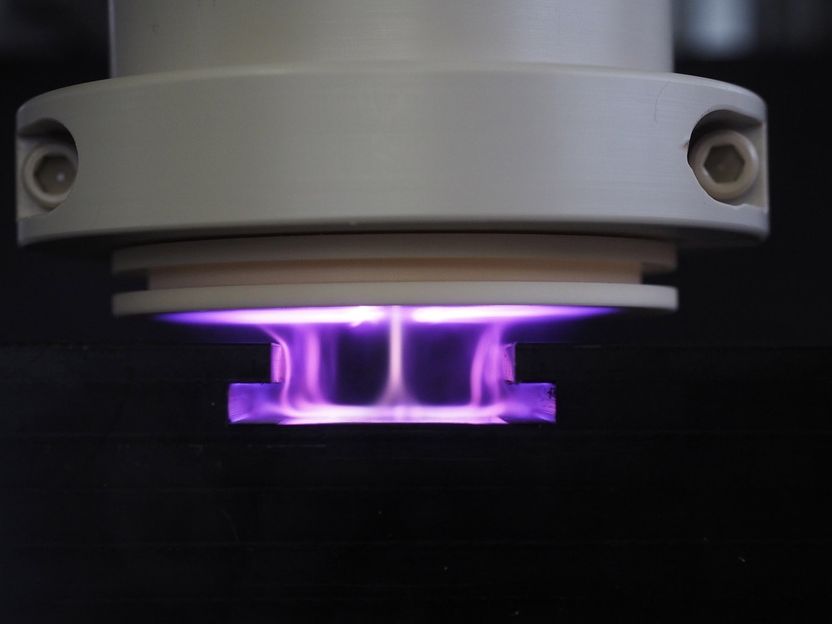

Cold plasma: Get started with the Disc Jet

Queen's researchers develop technology to reduce cost of purifying natural gas

EMSA, Cefic and Cedre sign agreement for co-operation in the field of marine pollution involving chemicals

Gabriel Performance Products Announces the Acquisition of Ranbar Electrical Materials

LANXESS underpins BRIC strategy with two acquisitions in Asia - LANXESS to acquire chemical businesses of Indian company Gwalior Chemical Industries Ltd for EUR 82.4 million

List_of_drugs:_Cb-Ce

UCB Receives EMEA Positive Opinion and FDA Approvable Letter for Keppra® (levetiracetam) Intravenous Administration

Mechanical Completion of New POM Manufacturing Plant in China

Levels of pyrrolizidine alkaloids in herbal teas and teas are too high - The first non-representative results of a BfR research project show that efforts are required to minimise levels