Thermo Electron and Fisher Scientific to Combine in Industry-Transforming Transaction

Thermo Electron Corporation and Fisher Scientific International Inc. announced that the boards of directors of both companies have unanimously approved a definitive agreement to combine the two companies in a tax-free, stock-for-stock exchange.

According to the companies, the transforming merger will create the leading provider of laboratory products and services in the high-growth life, laboratory and health sciences industry. The new company will be named Thermo Fisher Scientific Inc. and is expected to have 2007 revenues of more than $9 billion. Thermo and Fisher have complementary technology leadership in instrumentation, life science consumables, software and services. By combining these capabilities, the company will be uniquely positioned to provide integrated, end-to-end technical solutions. Thermo Fisher Scientific will have an industry leading global sales and service organization with nearly 7,500 professionals serving its customers worldwide.

Under the terms of the agreement, Fisher shareholders will receive 2.00 shares of Thermo common stock for each share of Fisher common stock they own. Based on Thermo's closing price of $39.45 per share on May 5, 2006, this represents a value of $78.90 per Fisher share, or an aggregate equity value of $10.6 billion, not including net debt of $2.2 billion. Upon completion of the transaction, Thermo's shareholders would own approximately 39 percent of the combined company, and Fisher shareholders would own approximately 61 percent. The transaction will be treated as a reverse merger with Thermo as the acquirer.

Marijn E. Dekkers, president and chief executive officer of Thermo, will become president and chief executive officer of the combined company, and Paul M. Meister, vice chairman of the board for Fisher, will become chairman of the board of the combined company. Following the close of the transaction, Paul M. Montrone, chairman and chief executive officer of Fisher, will be stepping aside in support of the new management team. He will be concentrating on launching new business opportunities and will remain an adviser to the company. Jim P. Manzi, chairman of the board of Thermo, will serve on the board of directors of the combined company. Thermo Fisher Scientific's board of directors will be comprised of eight members, with five nominated by Thermo and three nominated by Fisher.

The transaction is subject to approval by both companies' shareholders as well as customary closing conditions and regulatory approvals. The transaction is expected to close in the fourth quarter of 2006.

Other news from the department business & finance

These products might interest you

Limsophy by AAC Infotray

Optimise your laboratory processes with Limsophy LIMS

Seamless integration and process optimisation in laboratory data management

LAUDA.LIVE by LAUDA

LAUDA.LIVE - The digital platform for your device management

Comprehensive fleet management options for every LAUDA device - with and without IoT connectivity

ZEISS ZEN core by Carl Zeiss

ZEISS ZEN core - Your Software suite for connected microscopy in laboratory and production

The comprehensive solution for imaging, segmentation, data storage and analysis

ERP-Software GUS-OS Suite by GUS

Holistic ERP solution for companies in the process industry

Integrate all departments for seamless collaboration

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

Spin-polarized electrons on demand - With a single electron pump, PTB researchers provide 'counted' electrons with the desired spin

Production capacities for bio-based polymers in Europe - Status quo and trends towards 2020

Schott increases professional development activities

Evonik establishes a Digitalization subsidiary - New subsidiary will collaborate with external partners and promising start-ups

Yale University and Leica Microsystems Partner to Establish Microscopy Center of Excellence

Celanese and Blackstone to Form Joint Venture in Acetate Tow

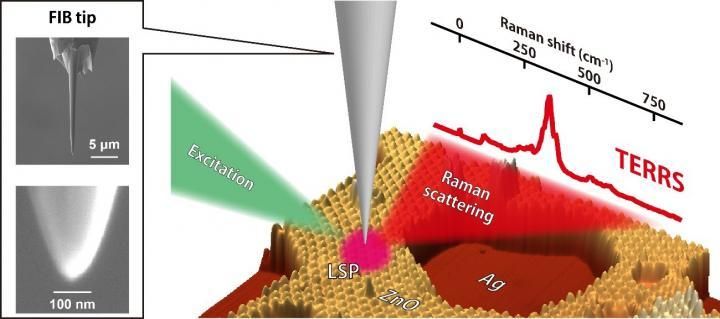

'Resonance' raman spectroscopy with 1-nm resolution