Cost-effective R&D Outsourcing Attracts Global Pharmaceutical Industry to India and China

Research Standards Set to be International; Government Regulations Encourage Outsourcing

The rise of India and China as global economies presents immense opportunities for the international pharmaceutical industry. Besieged by ever-increasing cost pressures, shorter product life cycles and numerous regulatory challenges in the West, the industry is increasingly shifting its research and development (R&D) base to these two developing nations.

This is being done primarily to minimise the expenses, time and risk involved in R&D. The estimations from industry sources reflect that the cost of bringing one new molecule into the market amounts to USD 800.0 million. The European Federation of Pharmaceutical Industries and Associations (EFPIA) estimates that, on an average out of 10,000 molecules developed in laboratories, only one or two will successfully pass all stages of drug development and be commercialised.

Pharmaceutical companies looking for effective solutions, thus, prefer outsourcing to low-cost, developing countries rather than persisting with expensive R&D efforts in the West. Alliances with local companies, contractual outsourcing arrangements and establishing local subsidiaries are good options for enterprises thinking of utilising the strong intellectual potential in India and China.

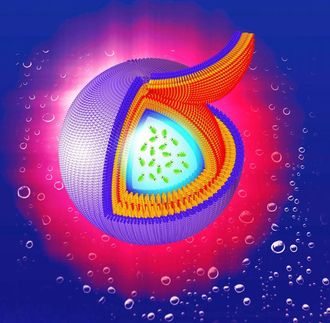

"Contract research organisations (CROs) are a popular option and carry out medical and scientific studies on a contractual basis for multiple clients," says Frost & Sullivan Industry Analyst Himanshu Parmar. "They provide part, or all of the processes of clinical research including clinical trial management, data management, statistical analysis, protocol design and final report development."

These outsourcing activities in developing countries amount to 20.0 to 30.0 per cent of total global clinical trials. Access to specialised skills in both countries and work hours on a 24/7 basis underpins their competitive advantage. In addition, better management from the start reduces development risks.

Despite these benefits, there has been a relatively low level of utilisation of the opportunities in both countries due to various concerns with respect to quality and infrastructure. Companies are worried about probable loss of control in processes and proprietary knowledge. Proper management is needed to utilise complicated and long-distance collaborative third-party relationships. Delays can even happen due to regulatory hold-ups.

This has motivated domestic companies and government in individual countries, keen to increase foreign participation and to figure prominently on the global map, to implement necessary changes to improve clinical research facilities.

"Government commitment in India and China to improve access to high-quality healthcare is a bonus for R&D outsourcing," says Mr. Parmar. "The regulatory environment in both countries is gradually changing in favour of clinical research."

Recent amendments to Schedule Y of Drugs and Cosmetics Rules of India, 1945, signify a progressive attitude on the part of the Indian Government, clarifying the environment for clinical research in the country. In China, regular monitoring of clinical trials ensures good clinical practice (GCP)-compliant research centres established by the government. These steps will enable the two countries attain international standards in pharmaceutical research.

For companies wishing to leverage the regulatory changes and high-quality research, considering alliance strategies and identifying regions of opportunity should be priorities. Embracing these changes through innovative strategies and flexible approaches will allow international pharmaceutical enterprises to capitalise on these new attractive propositions.

If you are interested in an analysis overview, which provides manufacturers, end users, and other industry participants with a synopsis, summary, advantages and disadvantages of pharmaceutical R&D outsourcing to India and China (B600-52) - then send an e-mail to Katja Feick - Corporate Communications using the 'Contact' button below.

Most read news

Topics

Organizations

Other news from the department business & finance

These products might interest you

Gilson MyPIPETMAN Select and MyPIPETMAN Enterprise Pipettes by Gilson

Grab the Gilson pipettes with your name and favorite colors!

Customise Your Pipettes to Fit Your Research

Whatman™ folded filter papers by Cytiva

Whatman folded filter papers

Convenient folded formats speed up your sample preparation

Systec H-Series by Systec

Safe, reproducible and validatable sterilization of liquids, solids and waste

Autoclaves with 65-1580 liters usable space, flexibly expandable for various applications

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.