CELLTECH ACQUIRES GERMAN SALES AND MARKETING ORGANISATION

Celltech Group plc (LSE: CCH; NYSE: CLL) today announced it has agreed to purchase Thiemann S.A., the owner of Thiemann Arzneimittel GmbH (“Thiemann”) for DM97.1 million (£31.2 million) in cash. This acquisition provides Celltech with a sizeable pharmaceutical sales and marketing organisation in Germany, the largest market within the EU.

The acquisition of Thiemann is an important step towards achieving Celltech’s strategic objective of building a pan-European sales and marketing structure. In particular it will provide:

A sales and marketing capability in Germany for Celltech’s key pipeline products, such as CDP 870 in Crohn’s disease.

An infrastructure from which field forces in adjoining European countries, such as Austria and Switzerland, could be supported.

It also increases Celltech’s attractiveness as a global marketing partner.

Dr Peter Fellner, Chief Executive Officer of Celltech, commented: “The acquisition of Thiemann provides Celltech with a focused presence in Germany, the largest European market for pharmaceuticals. We were particularly impressed by the quality of Thiemann’s management and its complementary therapeutic focus. We see this as a solid base upon which to build a specialist sales and marketing organisation, enabling us to maximise revenues from the marketing or co-marketing of key Celltech pipeline products in Germany.”

Thiemann is based in Waltrop, near Dortmund, and markets a range of products focused in the therapeutic areas of Gastrointestinal, Cardiovascular, Rheumatology, Cough/cold and Central Nervous System. Thiemann employs a total of 130 staff, including 87 in sales and marketing. In the year 2000 Thiemann had sales of DM76.6 million (£24.6 million), an operating profit before goodwill amortisation of DM8.4 million (£2.7 million) and net assets, predominantly goodwill, of DM37.1 million (£11.9 million).

Celltech will fund the acquisition from existing cash reserves, which amounted to £88.1 million at 30 June 2001. The purchase price of DM97.1 million is payable to Thiemann S.A.’s majority shareholders, DLJ Merchant Banking Partners (an investment fund within CSFB Private Equity), upon completion of the deal, expected in October.

Organizations

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

Vehicle battery of the Future

Körber-Stiftung - Hamburg, Germany

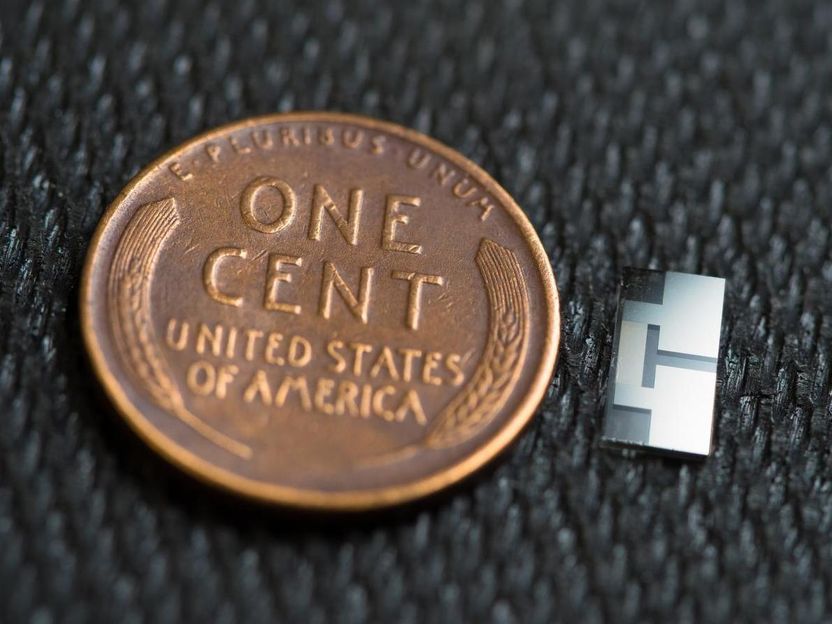

Ultrasound device improves charge time and run time in lithium batteries - The device brings lithium metal batteries one step closer to commercial viability

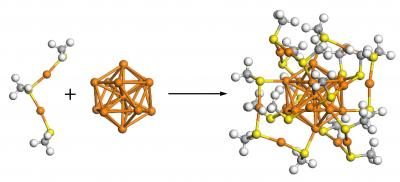

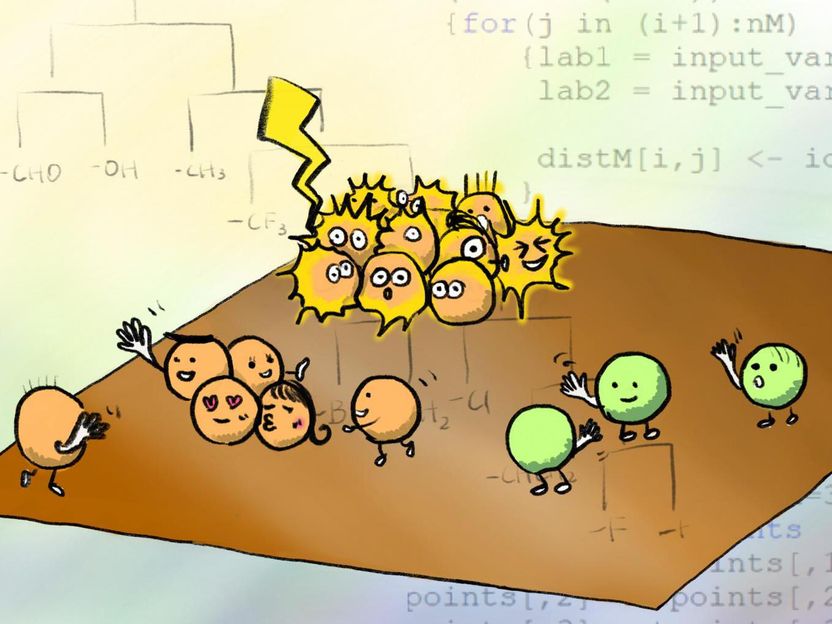

A new 'periodic table' for nanomaterials - New simulation helps scientists to decide what molecules best interact with each other

BASF and TU Berlin launch artificial intelligence cooperation

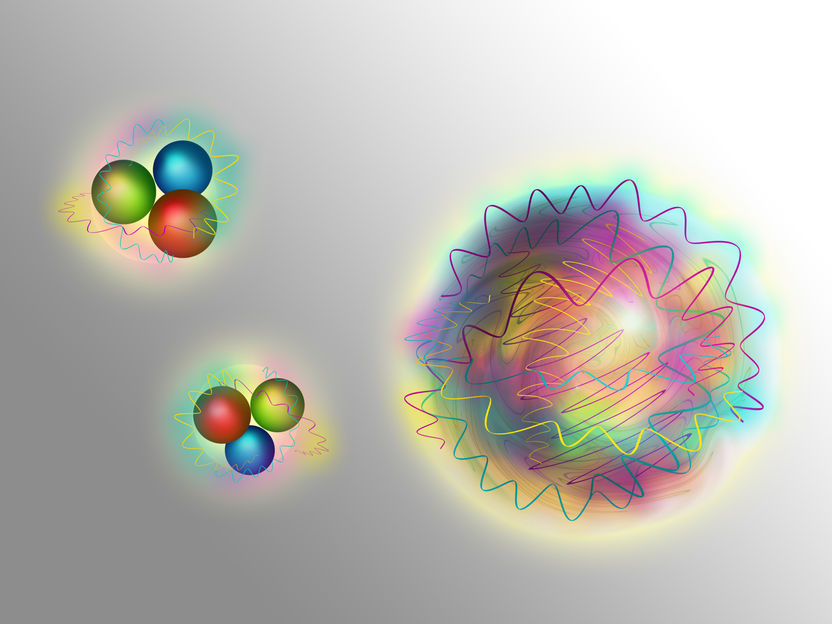

A particle purely made of nuclear force

Fraunhofer-Institut für Angewandte Optik und Feinmechanik IOF - Jena, Germany