Demand For High Performance Equipment Sustains Growth In Mature Industrial Weighing Machinery Markets

London, 02nd August 2004....Even as the increasingly mature European industrial weighing equipment market struggles with competitive pressures, untapped end-user sectors and emerging opportunities in Eastern Europe are poised to create new revenue streams. At the same time, higher productivity needs across a range of key industrial sectors are expected to boost demand for advanced weighing machinery.

In 2003, the total European industrial weighing machinery market was estimated at $1.06 billion, having fallen from $1.11 billion in 2000. This decline was attributed to the general economic slowdown, the shift of manufacturing activities to China and other low-cost regions and overall price pressures.

From 2004, the market is expected to stage a recovery with overall revenues forecast to reach $1.27 billion in 2010. The focus during this period is likely to be on offering improved weighing equipment at ever more competitive prices.

The push by end-user companies for more productive and cost-effective processes is expected to generate demand for faster and more accurate weighing systems. This is likely to create opportunities for weighing machinery manufacturers that can supply leading-edge solutions.

"End-users in the pharmaceuticals and food and beverage industries expect more accurate, higher precision, faster weighing solutions, reliable user-friendly software and other product enhancements," states a new study by Frost & Sullivan (http://www.frost.com).

"These act as drivers for the equipment manufacturers by either replacing older equipment or selling new products to the end-users. Investment in more advanced technology benefits revenues in that advanced machinery is generally higher priced, positively influencing revenue growth."

At an estimated $373.0 million, the food, dairy and beverage end-user sector contributed more than a third of the industrial weighing machinery markets revenues in 2003. The requirement for greater control and accuracy in weighing solutions, stricter regulations and the trend towards packaging of fresh foods are all set to sustain above average growth rates in this sector, with its revenue share projected to increase to 36.0 per cent in 2010.

However, as revenues stagnate in several other well-established end-user sectors, weighing equipment manufacturers have been compelled to explore new markets. Of these, waste management, recycling and environmental sectors are expected to rank amongst the fastest growing segments.

The need for more accurate weighing solutions is anticipated to support future growth in the large Western European markets of Germany, France, the United Kingdom and Italy. At more than twice the size of second placed France, Germany is forecast to remain the largest market.

The fastest growth is project, however, to be registered in Eastern Europe. Lower market maturity, demand for advanced technologies and migration of production facilities eastwards are set to push growth rates to a level significantly above the overall European average, with Poland, the Czech Republic and Hungary leading the way.

In product terms, the largest individual segment in 2003 was balances and scales, which accounted for an estimated 38.4 per cent of total market revenues. Widespread use across multiple application sectors, along with high demand from the industrial, the food, dairy and beverage and the chemical sectors is expected to help this product category maintain its dominance over the long term.

With over three hundred participants in the market, competitive pressures are expected to remain high. Critical differentiating factors are expected to be price, technical expertise, service and reputation. In particular, market advantage is expected to derive from cost competitiveness and leadership in customer service.

"As business increasingly becomes focused on building closer relationships, service will become a key means of differentiation," the study concludes. "Moreover, by emphasising competitive prices, manufacturers are able to meet the rising customer demand for ever more advanced and competitive technology."

If you are interested in a summary of this research service providing an introduction to the European industrial weighing machinery market, please use our "Request Information" button.

Most read news

Topics

Organizations

Other news from the department business & finance

These products might interest you

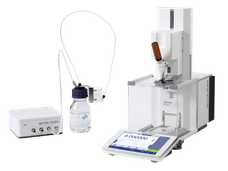

MS-Präzisionswaagen by Mettler-Toledo

Trusted Results at Your Fingertips

Capacity from 320 g to 12.2 kg, readability from 1 mg to 100 mg

Good Weighing Practice by Mettler-Toledo

Your Concrete Weighing Quality Assurance Plan

GWP Verification service

Automatische XPR-Waagen by Mettler-Toledo

Production of standards, samples and concentrations - fast and reliable

Automate the weighing processes in your laboratory - ideal also for sample prep at chromatography

Precision balances by Ohaus

High-performance precision balances for everyday use in laboratories & industry

From milligram-accurate measurement of small samples to routine weighing in the kilogram range

XPR Precision Balances by Mettler-Toledo

Fast and Accurate Precision Weighing Even in Difficult Conditions

XPR Precision Balances / Solutions to support you with data management, traceability and regulatory compliance

Carepacs by Mettler-Toledo

Professional CarePacs for smooth routine testing

Tweezers, gloves and other accessories for professional weight handling

Balances analytiques by Ohaus

Analytical balances with outstanding weighing performance, as easy to use as a smartphone

These space-saving analytical and semi-micro balances are surprisingly intuitive to use

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.