GPC Biotech AG announces fiskal 2000 Year-End Results

GPC Biotech AG (Neuer Markt Frankfurt: GPC), a leading genomics- and proteomics-driven drug discovery company, today announced results of operations for the fiscal year ending December 31, 2000.

The Company reported that consolidated net revenues for fiscal year 2000 increased 156 % to EUR 10.9 million, from EUR 4.3 million for fiscal year 1999. The revenue growth resulted primarily from the successful commercialization of the Company’s integrated technology platform through alliances with pharmaceutical partners including Aventis Pharma, Bayer AG, the Altana AG pharmaceuticals group Byk Gulden and DuPont Pharmaceuticals Company (1).

The Company’s practice for revenue recognition from alliances has, for past years, been consistent with the transparent accounting principles now required by the US Securities and Exchange Commission’s Staff Accounting Bulletin No. 101 (SAB 101). Hence, no restatement of historical financial statements and no adjustments to projections were required and GPC Biotech incurred no extra charges as a result of this new rule.

Purchase accounting was used to account for the acquisition of Mitotix, Inc., leading to one-time charges of EUR 16.0 million in the first quarter of 2000 for acquired in-process R&D and a charge of EUR 3.7 million over last three quarters in 2000 for amortization of intangibles, none of which were cash relevant. Other one-time charges related to the acquisition total EUR 1.6 million. Non-cash one-time charges of EUR 1.2 million were incurred for in-licensing compounds from the DuPont Pharmaceuticals Company. Non-cash relevant stock options expenses amounted to EUR 2.1 million for 2000. Excluding the acquisition-related charges EBITDA & SOP (EBITDA before stock option expenses) was (EUR 13.0) million in 2000, compared to (EUR 2.5) million in 1999.

The net loss was better than management’s expectations and analysts’ consensus estimates and amounted to EUR 35.3 million for 2000, compared to a net loss of EUR 3.3 million in 1999. This translated to a loss per share (2) before acquired in-process R&D and amortization of intangible assets of EUR 1.07 compared to EUR 0.54 in 1999. Basic and diluted loss per share amounted to EUR 2.42.

The Company had EUR 108.7 million in cash and available-for-sale securities as of December 31, 2000. This provides GPC Biotech with a very strong financial position. Net cash used in operations amounted to EUR 18.5 million during 2000 (1999: EUR 0.2 million). Of the EUR 48.7 million in total expenses for the fiscal year 2000, EUR 21.0 million were non-cash relevant as the special charges detailed above had no effect on net cash used in operations.

“The year 2000 was undoubtedly the most successful year in GPC Biotech’s corporate history,” said Dr. Bernd R. Seizinger, President and CEO of GPC Biotech. “The acquisition of the US biotech company Mitotix, Inc. allowed GPC Biotech to aggressively forward-integrate to become one of the premier European biotech companies. Six additional corporate alliances through January of 2001 and the achievement of significant progress in all areas of our product programs demonstrate the strength of our integrated technology platform and our drug discovery pipeline. We successfully started into the year 2001 with new large pharmaceutical alliances with Boehringer Ingelheim International GmbH and the Altana AG subsidiary Byk Gulden. With a value of up to US$ 100 million plus royalties, our collaboration with Byk Gulden is arguably the largest pharmaceutical alliance in German biotech to date. Hence, we are well positioned for further expansion and growth.”

Organizations

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

Energy Storage in Molecules - Optimizing Molecular Photoswitches for Solar Energy Harvesting

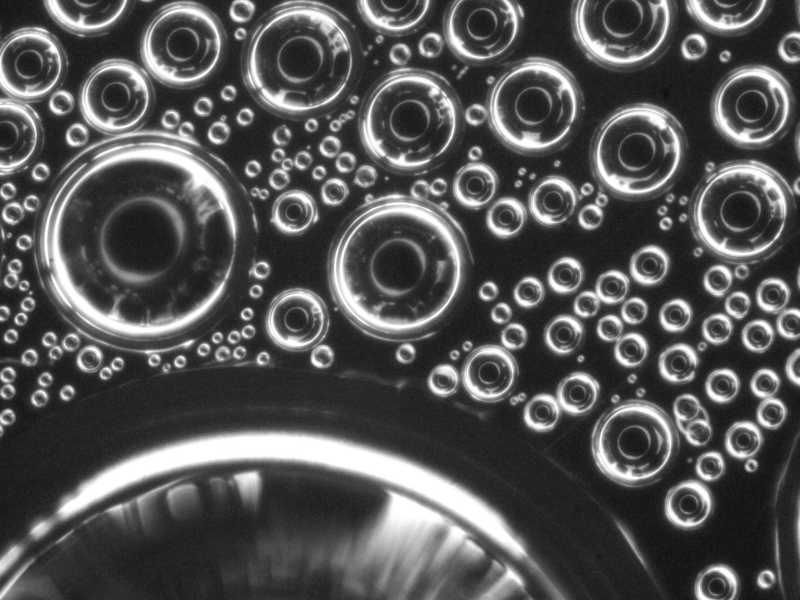

Small droplets grow differently - Initially, there is an unexpected growth spurt when droplets grow from moisture condensing on a surface

New catalyst paves way for carbon neutral fuel

Executive Director of FIZ CHEMIE to be General Secretary of IUPAC

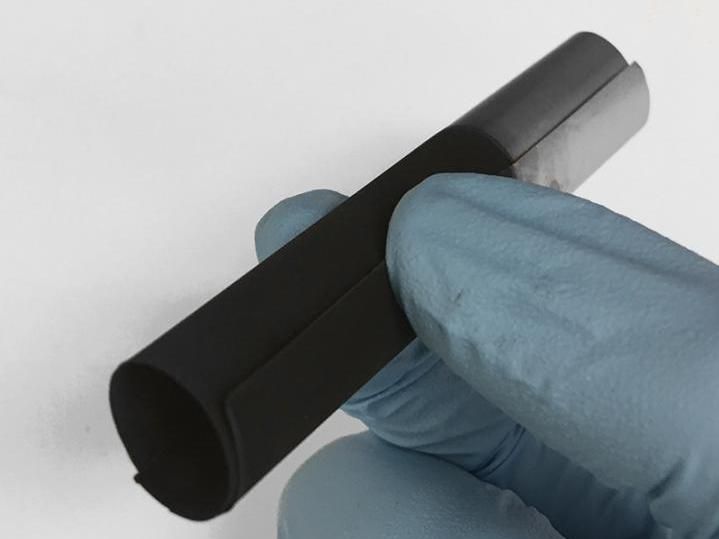

Electroplating delivers high-energy, high-power batteries

DKSH opens sales office in Sri Lanka and accomplishes major expansion into the Indian subcontinent