Carbon capture is helped by oil revenue, but it may not be enough

The oil industry incentivises the development of carbon-capturing tech, but researchers say this will not reduce emissions to low enough levels.

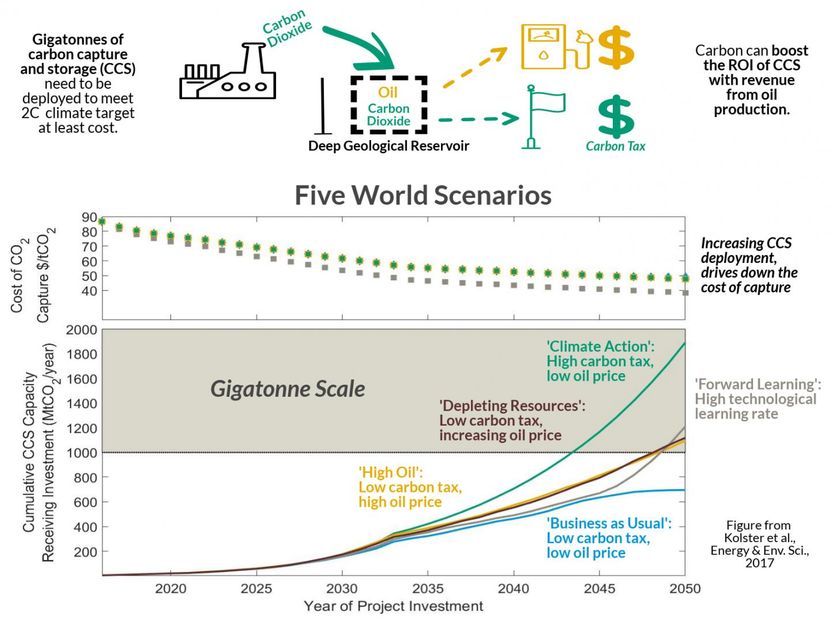

Comparing world scenarios and CCS development.

Imperial College London

Carbon dioxide can be used to extract oil, accelerating the development carbon-capturing technologies and limiting climate change. However, in a new analysis researchers say this will not be enough to reduce emissions to the level recommended by climate scientists.

Carbon capture and storage (CCS) is the process of trapping carbon dioxide from fossil-fuel power plants and burying it safely underground. By preventing carbon dioxide from reaching the atmosphere, CCS can help slow global warming and is recognized as a key technology to meet the Paris Climate Agreement.

CCS has the potential to stave off dangerous levels of global warming, but its deployment is not yet widespread. However, in a new study researchers from Imperial College London and Stanford University suggest the oil industry may play a surprising role in accelerating CCS's development.

Enhanced oil recovery injects carbon dioxide into oil wells, flushing out oil from the surrounding rocks and allowing more oil to be produced from a reserve. Fossil-fuel power plants are a ready source of carbon dioxide for this process.

In fact, many of the largest CCS projects in the world are connected to enhanced oil recovery operations. This investment could help accelerate the development of CCS, but the authors of the new study note this is unlikely to be enough on its own.

The team developed a model they name MIICE (Model of Iterative Investment in CCS with CO2-EOR) to test the influence of different factors on the growth of CCS technologies up to 2050. The three primary drivers were oil price, which would drive enhanced recovery efforts; carbon tax levels, which would incentivize the trapping of carbon dioxide; and how fast knowledge is gained about the technology, allowing innovations to drive down capital costs.

They found that while oil prices and carbon taxes were helping, they are not yet at levels needed to reach the kind of deployment of CCS necessary by 2050 to avert dangerous climate change. However, the oil industry input could still be crucial at this early stage.

Clea Kolster, lead author and PhD student with the Grantham Institute at Imperial, said: "Revenue from oil does make the deployment of CCS far more attractive in the near term by providing the majority of capital in early years before carbon dioxide tax incentives have increased sufficiently to overtake oil revenue.

"This suggests that carbon dioxide storage with enhanced oil recovery can play a crucial role in the key early years of development when major cost reductions will occur due to technological learning."

Taking each factor independently, the team found that CCS only achieves the necessary deployment under one of the following conditions: the price of oil is greater than $85/barrel; the carbon tax incentives increase dramatically to above $75 per tonne of carbon dioxide by 2050; or learning rates for technology deployment are sustained at a high rate, with 14% cost reduction for every doubling of deployment.

Professor Adam Brandt of the Department of Energy Resources Engineering at Stanford University, and senior author on the study, said: "These conditions exceed the current state of energy and environmental markets and suggest that further intervention, for example from governments, is required to boost the deployment of CCS to rates consistent with suggested pathways for avoiding dangerous climate change."

MIICE is an open-source model that can be used to test a range of possible future scenarios, providing insight into the optimum combinations of conditions that will lead to the necessary scale-up of CCS by 2050.