Kraton™ sale completion marks end of Shell's divestment programme

The Royal Dutch/Shell Group of Companies (Shell) today announced the completion of the last sale in its extensive chemicals divestment programme. The sale of the global KRATON™ Polymers business to Ripplewood Holdings L.L.C., a private equity investment firm based in New York, ends the programme first outlined in December 1998.

The divestment programme is in line with the strategic drive of the Shell Group's chemicals companies to focus on those businesses closer to base and intermediate chemical building blocks, typically high-volume petrochemicals.

The programme has produced a $5.7 billion reduction in capital employed by the Group in chemicals businesses compared with the original $5 billion target.

"By completing the divestment programme we have reached a major milestone in implementing our strategy for Shell's chemicals business," said Evert Henkes, CEO of Shell Chemicals Limited. "With our new, more focused portfolio, Shell Chemicals is better positioned than ever for world-class performance and for creating exceptional value for customers."

The KRATON Polymers business manufactures and markets thermoplastic elastomers which are used in applications such as adhesives and sealants, asphalt/bitumen modification, footwear, and moulded and extruded products. The manufacturing plants are in the United States, The Netherlands, Germany, France, Brazil and Japan (via a joint venture with JSR Corporation). In addition, there are global sales and marketing networks and research and development facilities. The business has annual revenues of approximately $600 million. General terms and conditions of the transaction as well as the purchase price were not disclosed.

Most read news

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

Magnesium_oxide

James_Muspratt

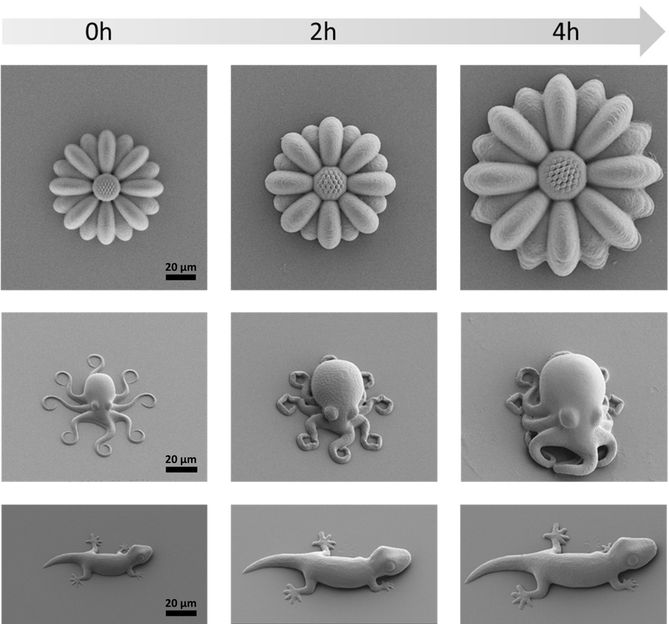

Microscopic Octopuses from a 3D Printer - Newly developed smart polymers have “life-like” properties

Jean_Coutu_Group

Epidosite

Isobutane