Axalta Coating Systems to acquire Valspar's North American industrial wood coatings business

Axalta coating systems announced that it has entered into a definitive agreement with The Valspar Corporation and The Sherwin-Williams Company to acquire the assets related to Valspar’s North American Industrial Wood coatings business for $420 million in cash. Valspar is divesting the business in connection with the reviews by the Federal Trade Commission (FTC) and Canadian Competition Bureau (CCB) of the proposed acquisition of Valspar by Sherwin-Williams. The business had revenues of approximately $225 million in 2016 and is one of the leading providers of coatings for OEM and aftermarket Industrial Wood markets, including building products, cabinets, flooring and furniture in North America.

Known in the market today as Valspar Wood, the business has a number of widely known and respected brands including Zenith ® , Lustre Lac™ and Graintone™, among others. These products are backed by a strong R&D and technology organization and best-in-class customer service.

“This is an outstanding opportunity for Axalta to enter the large Industrial Wood Coatings market with an industry-leading portfolio of products and customers,” said Axalta Chairman and CEO, Charlie Shaver. “The strong reputation enjoyed by these brands among a long-term customer base will provide an excellent platform for future growth in this important market. Our shared commitment to technology and excellence in application services, as well as a strong pipeline of new products, will enable us to meet the needs of both current and new customers. This acquisition continues to build on our strategy to strengthen and further diversify our Performance Coatings segment.”

Axalta intends to operate this business as a pure bolt-on. As part of the transaction, Axalta will acquire the personnel, both dedicated manufacturing sites, R&D assets and the underlying intellectual property of Valspar’s North American Industrial Wood Coatings business. The transaction is subject to the closing of the Valspar and Sherwin-Williams merger, as well as customary closing conditions and regulatory approvals, including the approval of the FTC and the CCB. Axalta has secured a financing commitment for the transaction through Deutsche Bank AG New York Branch, subject to customary closing conditions. Centerview Partners LLC acted as financial advisor to Axalta.

Most read news

Organizations

Other news from the department business & finance

These products might interest you

Dursan by SilcoTek

Innovative coating revolutionizes LC analysis

Stainless steel components with the performance of PEEK - inert, robust and cost-effective

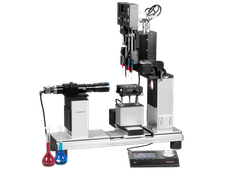

OCA 200 by DataPhysics

Using contact angle meter to comprehensively characterise wetting behaviour, solids, and liquids

With its intuitive software and as a modular system, the OCA 200 answers to all customers’ needs

Tailor-made products for specific applications by IPC Process Center

Granulates and pellets - we develop and manufacture the perfect solution for you

Agglomeration of powders, pelletising of powders and fluids, coating with melts and polymers

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.