Shale gas boom reduces prices

Ceresana presents the worldwide first study on the entire ethylene value chain in the USA

Advertisement

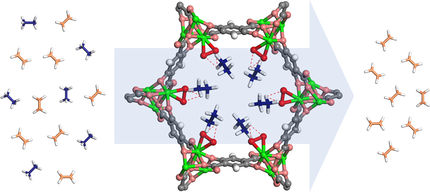

ethylene is the by far most important raw material in the Petrochemical industry. Consumption is immense: the USA single-handedly processed 25 million tonnes of ethylene in the past year. As the first market research institute ever, Ceresana has analyzed the entire ethylene value chain in a specific region, namely the USA. "This is the worldwide first study of its kind, it provides complete transparency of the ethylene market, beginning with feedstocks up to the final products", explains Oliver Kutsch, CEO of Ceresana: "The value added in downstream sectors is considerable. Besides polyethylene plastics, direct applications of ethylene include important chemicals such as alpha olefins used to increase rigidity of polyethylene, ethylene oxide needed in the manufacturing of PET plastics, and ethylbenzene, which is predominantly processed into polystyrene. Other applications are vinyl acetate monomer and the elastomer EPDM.“

Shale gas boom

Ethylene is mainly produced from ethane, propane, butane, and naphtha. The shale gas boom in the USA resulted in an unprecedented surge of announcements to construct new ethane crackers. Until 2018, US ethylene capacity is scheduled to increase by about half. Compared to other feedstocks, cracking of ethane yields a rather high amount of ethylene. Ceresana forecast approx. three quarters of ethylene output to be based on ethane in 2021.

Considerable decline of feedstock costs

The notable decline of prices for ethane in recent years has caused a significant change of the cost situation for manufacturers of ethylene. Average feedstock costs per tonne of ethylene manufactured fell by about 40% between 2008 and 2013. Manufacturing ethylene from ethane enjoys a notable competitive advantage: In the fourth quarter of 2013, cash costs (consisting of fixed, variable operational and feedstock costs minus profit generated with by-products) were two thirds lower when using ethane than when using naphtha as feedstock.

Polyethylene prime application

In 2013, about 60% of US demand for ethylene was accounted for by producers of these plastics. Depending on density and rigidity of the product, polyethylene is classified as either HDPE, LDPE or LLDPE. In the future, ethylene will mainly be utilized to manufacture polyethylene: Large new production site for HDPE and LLDPE in particular are being constructed. Given the upturn of the real estate sector and ever increasing consumption expenditure, prospects for domestic demand in the USA are good. The impulses in construction and packaging have corresponding effects on demand for polyethylene. However, sales volume of polyethylene on foreign markets has to rise notably in the future in order to ensure an acceptable degree of capacity utilization of US facilities.

Most read news

Topics

Organizations

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.