Ceresana Analyzes the Global PVC Market: Demand Is Increasing Steadily

Asia-Pacific remains the largest sales market

Ceresana Research expects the global PVC market to reach revenues of more than US$65 billion in 2019. Now that the global recession has ended, the construction industry will again boost demand for PVC. The average annual growth rate of 3.3% seen in the past eight years is likely to be surpassed in future. The market experts from Ceresana forecast PVC demand to increase at an average annual rate of 3.9% over the next years.

With a roughly 53% share of global consumption, Asia-Pacific is the largest PVC outlet, followed by North America and Western Europe. Shares in demand of the individual world regions will shift significantly over the next eight years. The analysts from Ceresana expect countries in Asia-Pacific to increase their shares in the global PVC market – mainly at the expense of industrial countries. In contrast, emerging and developing countries will benefit from an increasing per-capita consumption of plastic products. Moreover, the construction industry is boosting in these countries, where many PVC products are used in civil and structural engineering.

Changes in regional demand will also have an effect on the production structure of manufacturers. The global PVC capacity of about 50 million tonnes is projected to be expanded by 13 million tonnes by 2019. Almost 80% of these new capacities will be created in the Asia-Pacific region.

Applications and Demand

The most comprehensive report worldwide analyzes how PVC use will develop in individual markets. Most important buyers include manufacturers of pipes and conduits; they accounted for 39% of global PVC demand in 2011. PVC plastic profiles accounted for just less than 20%. Films and sheets had an 18% share. Cables and cable sheathing made up 7% of global PVC demand in 2011. Flooring had a 4% share. Other industrial applications include automotive coatings, medical products like infusion bags, as well as shoes. They accounted for approximately 13% of global demand.

All application areas will see similar demand development over the upcoming eight years. As a result, shares of the individual application areas will shift only slightly by 2019. Pipes and conduits will see the smallest increase in demand of 3.7% per year. However, this sector will remain the largest PVC outlet by 2019.

Most read news

Organizations

Related link

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

Krahn Chemie becomes the new distribution partner of Ferro

GPC Biotech Is the First German Biotech Company to Adopt Voluntary Corporate Governance Principles

WorleyParsons awarded Evonik contract

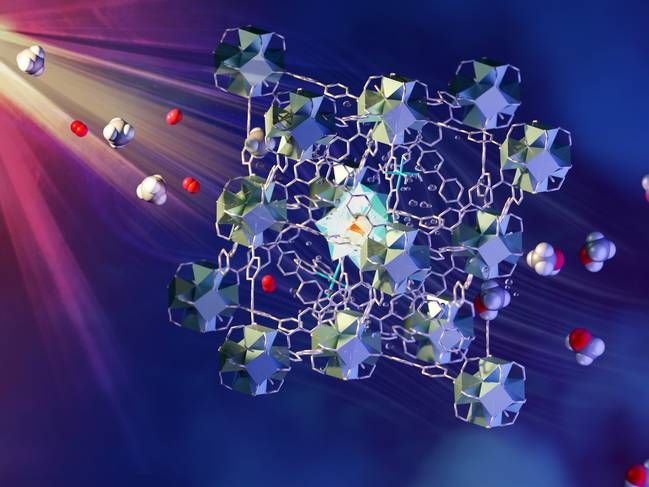

Building-Kit Catalyst - Metal-free organic framework for electrocatalytic production of ethylene from carbon dioxide

Found: The ‘holy grail of catalysis’ - Turning methane into methanol under ambient conditions using light

A cooler way to protect silicon surfaces - New room-temperature process could lead to less expensive solar cells and other electronic devices

BP and NOVA Chemicals sign binding agreements for European Styrenics Joint Venture

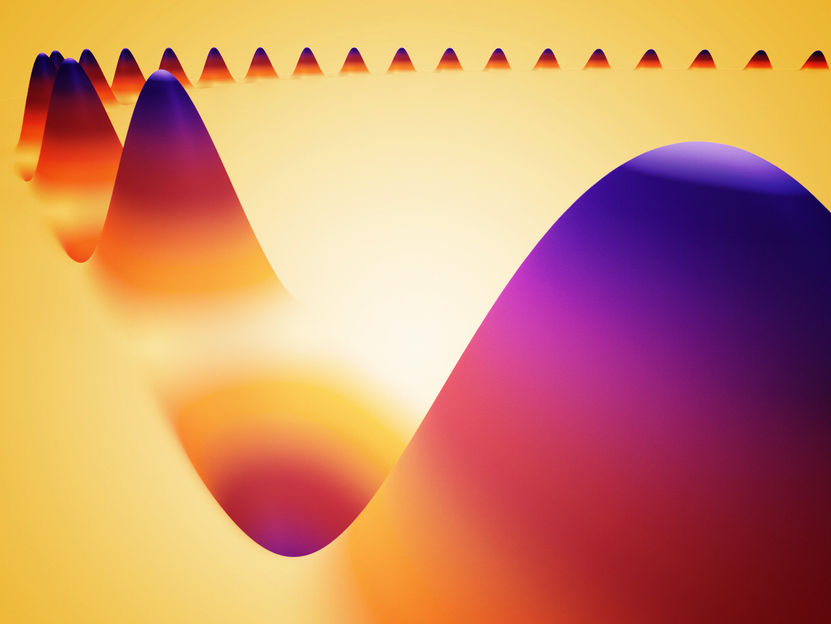

A new spin in nano-electronics - Researchers succeed in controlling extremely short-wavelength spin waves

SCHOTT to Open New Production Site for High Quality Pharmaceutical Packaging in China

Protecting Plastics and Rubber: Ceresana Analyzes the Stabilizer Market

Acids, Alkalis, and the pH Scale