Sika AG: Still growing strong

Sika increased sales by 17.2% in local currencies in the first nine months of the year. The company witnessed double-digit growth in all regions apart from Europe South. The result for the third quarter was also pressured by continually rising raw material prices and currency effects.

Sales

In the first nine months of the current business year, Sika increased sales by 17.2% in local currencies, including an acquisition effect of 3.9%. Translated into CHF, sales were up by 3.2% year-on-year from CHF 3 318.6 million to CHF 3 424.8 million.

Regions

Sika posted gains in local currencies in all regions. As was the case in the first half of the year, Sika could rely on sustained strong demand from the emerging markets. In North America too, Sika gained further share in a fiercely contested market. While Europe North saw double-digit growth, Europe South was able to maintain single-digit growth thanks to the French and UK markets. Broken down by regions, Sika reported the following local currency sales growth for the first nine months: Asia/Pacific 37.0%, North America: 25.1%, Latin America 22.6%, IMEA (India, Middle East and Africa) 13.1%, Europe North 11.8% and Europe South 4.2%.

Earnings

At end-September 2011 the gross margin stood at 50.8% (end-September 2010: 54.7%), due primarily to higher raw material prices. The substantial price rises faced in the first and second quarters will feed through to margins in the third and fourth quarters with a time lag. Likewise, the sales price increases subsequently implemented will not have an impact until after a certain delay and so failed to offset continually rising material costs.

Despite the expansion drive underway in the emerging markets, Sika saw a 0.8 percentage point improvement in cost efficiency (costs expressed as a percentage of net sales) from 40.5% to 39.7%. Operating profit (EBIT) after nine months came to CHF 281.3 million (previous year: CHF 368.7 million), corresponding to a margin of 8.2% (previous year: 11.1%). Consolidated net profit amounted to CHF 169.3 million (previous year: CHF 249.2 million).

Outlook

Apart from country-specific exceptions (North Africa), the outlook in the emerging markets remains positive. In Europe, on the other hand, the situation is somewhat uncertain. While key operating figures do not reveal any noticeable levelling off of business, the financial and political backdrop makes it difficult to gauge developments going forward.

Since increases in material prices only impact on the income statement after a delay of 3 to 6 months, the gross result will remain under pressure. Accordingly, efforts to lift sales prices will continue.

Even factoring in further efficiency increases on the cost side, net profit for full year 2011 will be well below the figure for 2010.

Organizations

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

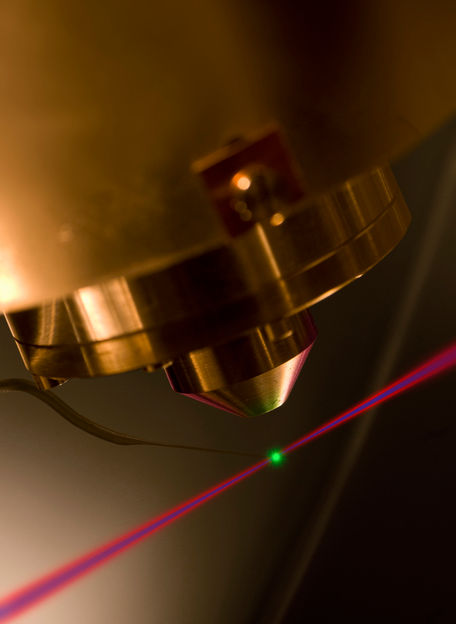

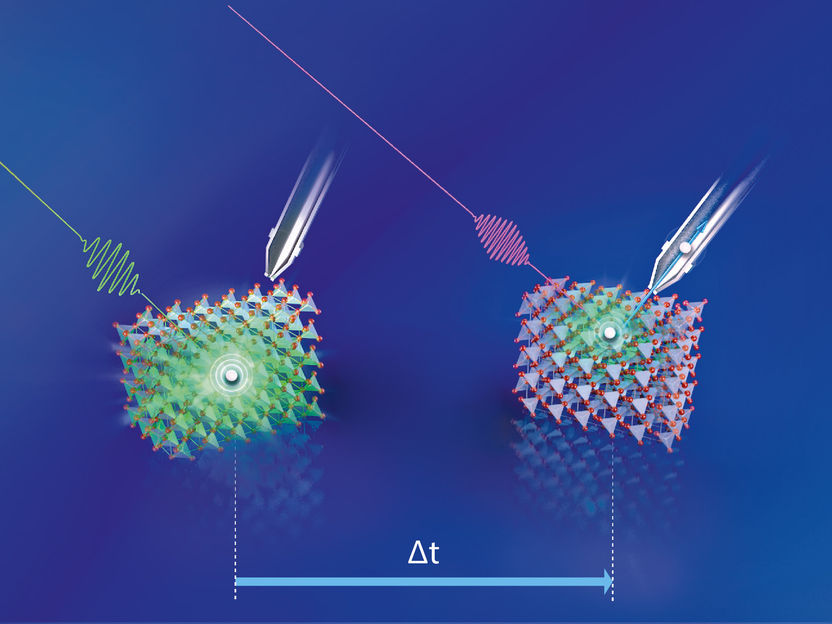

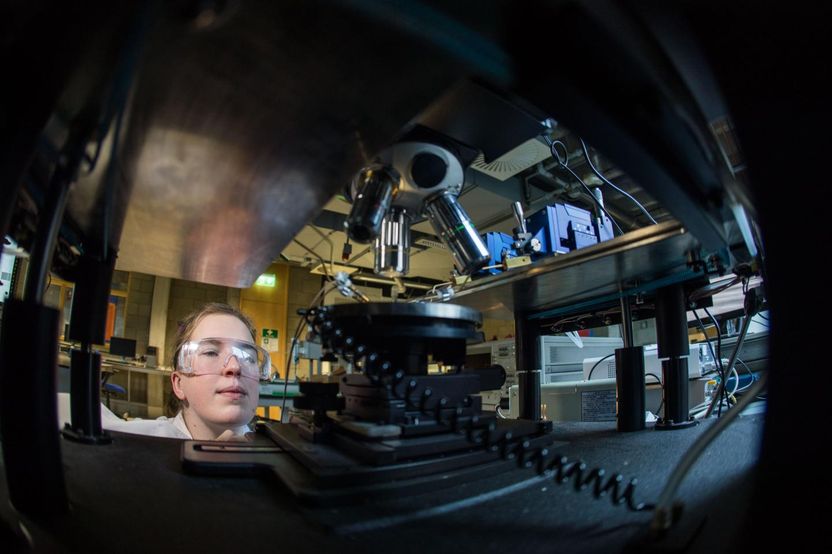

Copper oxide photocathodes: laser experiment reveals location of efficiency loss

Turkey: Rising demand for oil and gas will fuel automation and control systems

Squeezing low-cost electricity from sustainable biomaterial

Novasep Process SFC systems wins Bronze 2005 CPhI Innovation Award

ACC anounces finalists for the 2009 Polyurethane Innovation Awards

Category:Biofuel_power_stations_by_country

Reutter GmbH - Leutenbach Nellmersbach, Germany

Category:Biofuel_power_stations_in_the_United_States

BASF to expand its plant biotechnology research into fungal resistance in corn

AVT GmbH Becomes Part of the Busch Group - “In AVT GmbH we are winning a competent partner for the heat treatment equipment service business”

C-LAB Chemievermittlung GmbH - Birkenfeld, Germany