Lonza to acquire Arch Chemicals

Lonza Group Ltd and Arch Chemicals, Inc. announced that they have signed an agreement pursuant to which Lonza has agreed to commence a tender offer for 100 percent of Arch Chemicals’ outstanding shares of common stock at a price of USD 47.20 per share in cash.

Lonza’s offer represents a 36.7% premium to Arch Chemicals’ average closing price over the last 30 trading days. Based on the offer price for all the outstanding shares, Arch Chemicals’ enterprise value would be USD 1.4 billion (approximately CHF 1.25 billion).

Lonza’s cash offer is subject to customary conditions including the tendering of more than two-thirds of Arch Chemicals’ outstanding shares of common stock and clearance from antitrust regulatory authorities. Lonza expects to commence the tender offer by 15 July 2011 and to complete the tender offer later in 2011.

Stefan Borgas, CEO of Lonza, said: “This transaction represents an excellent strategic and cultural fit. Lonza and Arch Chemicals offer highly complementary products and technologies and together will be the global leader in controlling unwanted microbes. The business will enjoy a strong platform for accelerated future growth for the benefit of all our stakeholders.”

Upon completion of the transaction, Lonza will have the world’s leading microbial control business with 2010 pro-forma sales in this life science market of approximately USD 1.6 billion, combining the complementary product solutions of both companies.

Microbial Control – a global growth opportunity

The global microbial control market is currently valued at approximately USD 10 billion, and is growing at approximately 4-6% per annum. The key end-use segments of the market -- water treatment, hygiene, materials protection and personal care -- are growing at faster rates. The largest markets are North America, Europe and Japan. The fastest growing microbial control markets are Brazil, India, China and South Africa.

Organizations

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

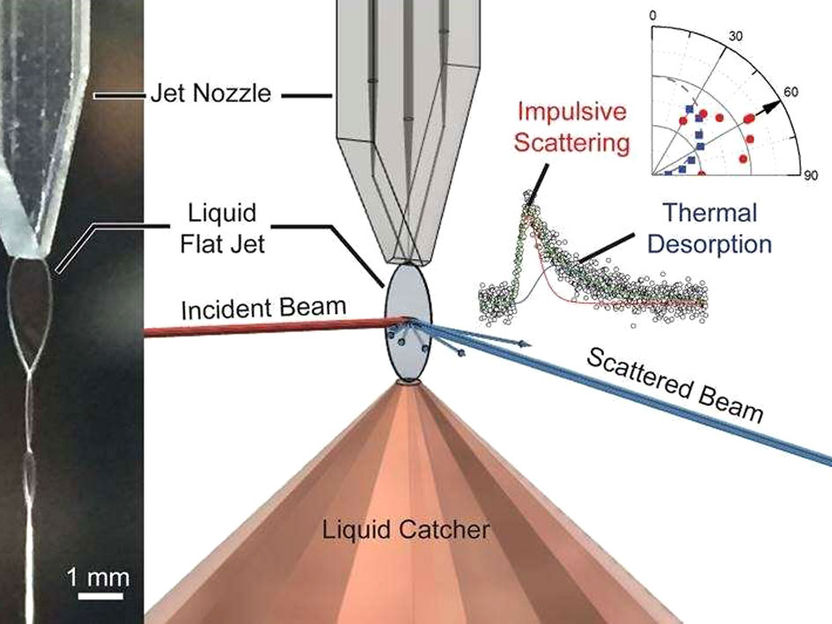

Novel method examines the gas-liquid interface in new detail - Novel molecular beam scattering apparatus that uses a liquid flat jet can study chemical reactions at the gas liquid interface of volatile liquids

LANXESS increases prices for acrylate chemicals

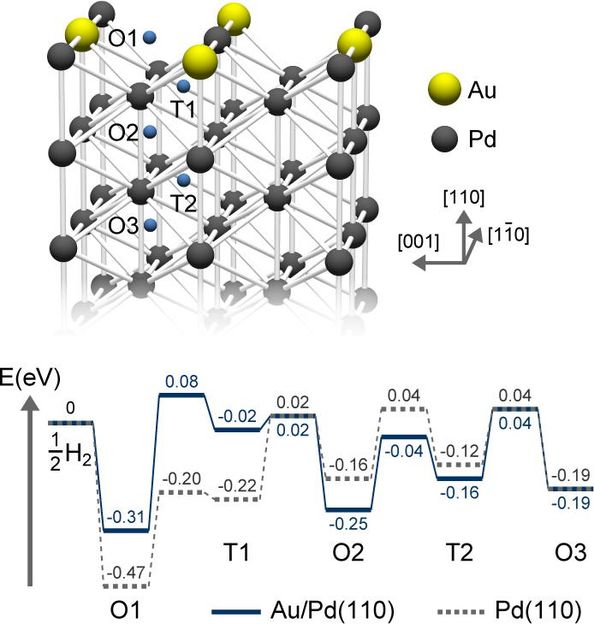

Saltigo focuses on palladium-catalyzed cross-coupling reactions - Nobel Prize-winning chemistry in industrial use

With quantum chemistry and prominent investors to green methanol - Berlin-based start-up aims to make the chemical industry more sustainable and less dependent on fossil imports

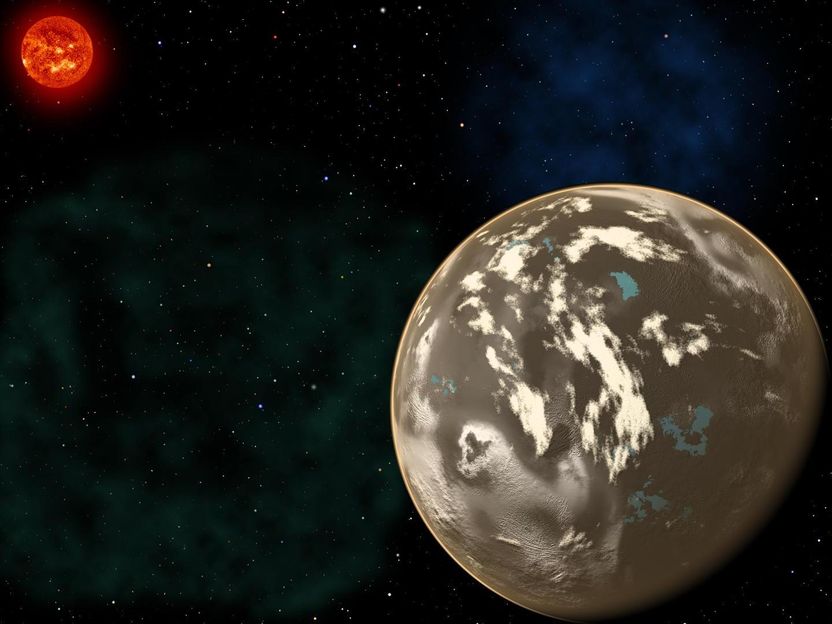

Universe's first life might have been born on carbon planets

Markus Lusser is new president of Leica Microsystems