Azelis to acquire S&D Group Ltd, UK

Azelis has signed a definitive agreement to acquire S&D Group Limited, a specialist supplier of raw materials and ingredients to the pharmaceutical, food, personal care and performance chemicals industries.

The acquisition of S&D Group is strategically important as it will significantly strengthen the Azelis Life Science business (Pharma, Food & Health and Personal Care), both in terms of portfolio coverage as well as geographic spread.

Joris Coppye, Group Chief Executive Officer of Azelis says: “This acquisition is one of the biggest in the entire Azelis history and is of significant strategic importance. S&D will give Azelis a leading position in Personal Care and Pharma in the CEE region, including the CIS countries. Furthermore the acquisition will support the consolidation of our Indian distribution business (mainly Chemicals and Plastic Polymers) with the addition of Life Science activities. In China we will be able to complement our existing sourcing operations with distribution activities. Last but not least the acquisition of S&D is an important step change towards globalisation through the access to new markets such as Canada, Australia, Middle East and Africa.”

Peter Straus, co-founder and owner of the S&D Group adds: “Azelis is a company with a dynamic reputation in the market and is therefore the best platform to expand the operations of S&D in speciality chemical distribution. Once the amalgamation has been completed, the joint organisations will ensure a strategic position across Europe, create synergies and expand their distribution network for the benefit of suppliers and customers. This is a further major step in the growth story of S&D and I am happy that the company will soon have a new home within a strong group that shares the same core values. The retained businesses will continue to operate and expand under their current management.”

Excluded from the acquisition are those S&D companies involved in the pharmaceutical finished dosage (S&D Pharma), chemical synthesis and laboratory supply markets (Chemgo), as well as part of its personal care actives business (S&D Chesham GmbH and ProTec Ingredia), - these entities will retain their original ownership.

The completion of the acquisition is subject to cartel clearance and is expected to close within the first quarter.

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

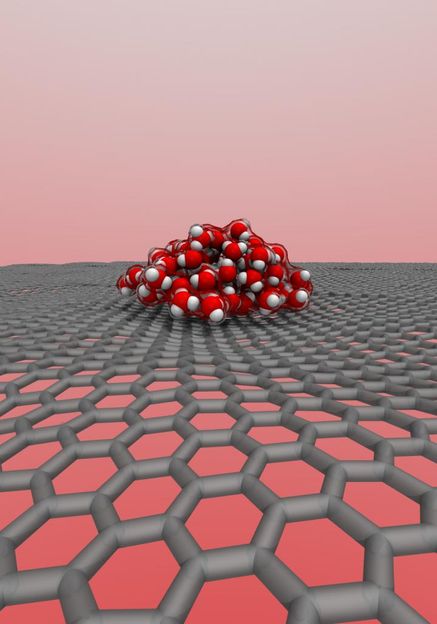

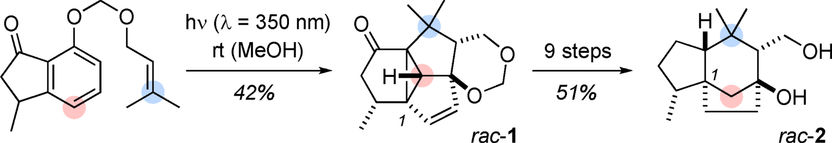

Productive Cascade - Total synthesis of the sesquiterpene agarozizanol B

Acoustic propulsion of nanomachines depends on their orientation - Particles can be used for biomedical applications

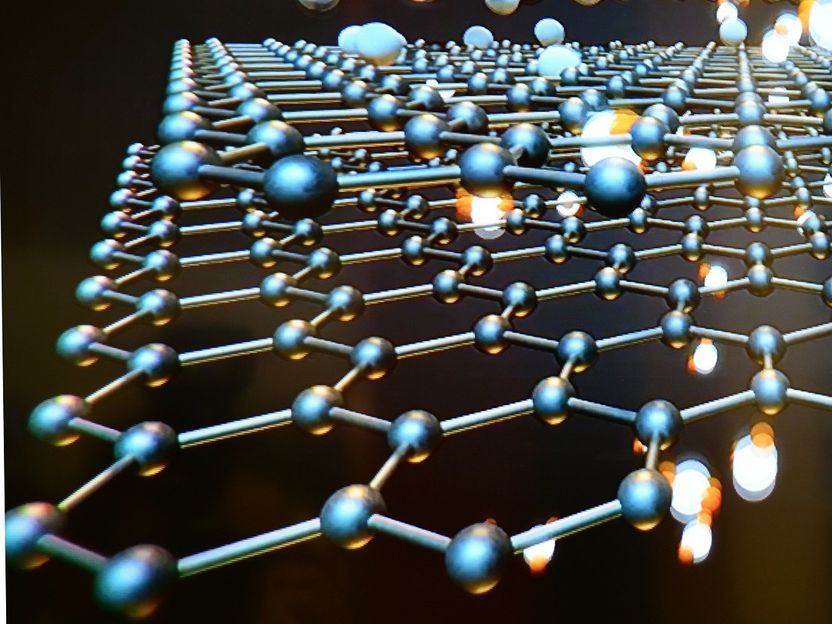

Breakthrough in the synthesis of graphene nanoribbons - Graphene Nanoribbons might soon be much easier to produce

The_Rock_(Northwestern_University)

Association of Analytical Communities Research Institute (AOAC) - Gaithersburg, USA

Clariant closes Süd-Chemie acquisition - Clariant holds 96.15% in Süd-Chemie after closing