Clariant further improves profitability based on better demand and reduced cost base

Clariant announced sales of CHF 1.894 billion in the second quarter 2010, compared to CHF 1.609 billion in the previous year. Sales increased 18% in Swiss Francs and 20% in local currency.

Volumes were up 20% over an extremely weak second quarter 2009, but remained significantly below pre-crisis levels. On the back of a broad economic recovery, Clariant reported sales growth across all businesses and regions. The Business Units Pigments, Additives, Leather and Masterbatches benefited the most from the improved economic environment and grew above group average.

Against the backdrop of the depreciation of the Euro against the USD and an increased competitiveness, demand in Europe developed better than expected compared to the low basis year on year, which resulted in a strong 22% sales growth for Clariant. Demand in the regions Asia, Latin and North America increased as well, favorably affecting the company's sales volumes.

Clariant significantly improved the gross margin to 28.9% from 24.8% year on year, based on good capacity utilization. Sequentially, the company increased sales prices by 1% in order to respond to a 4% uptake in raw material costs. However these price increases have not been sufficient yet to fully compensate for the feedstock markup and will be intensified in the coming months in particular as raw material costs are predicted to further increase.

Despite the negative margin squeeze Clariant managed to keep the gross margin stable sequentially also due to a favorable development of exchange rates and higher volumes.

As part of its Global Asset Network Optimization (GANO) efforts Clariant continued to improve the structure of its production facilities and decided to relocate the Pigments site in Tianjin (PR China) - as part of the consolidation of the Pigments activities in China - and to close Pigments production in Onsan (South Korea). Both sites will have stopped their operations in 2010/11. At the same time the investment in a new ethoxylation plant in Dayabay (PR China) is proceeding as planned. The site will go on stream in early 2011.

As a result of the ongoing focus on cost reduction, SG&A costs decreased to 16.3% of sales, compared to 18.6% a year ago. In absolute terms, SG&A costs slightly increased to CHF 309 million, from CHF 299 million year on year, due to one time costs resulting from the restructuring projects and necessary IT upgrades. Personnel costs further decreased.

Consequently the operating income (EBIT) before exceptional items increased to CHF 211 million, compared to CHF 69 million a year ago and CHF 183 million in the first quarter of 2010. The EBIT margin before exceptional items improved to 11.1% from 4.3% a year ago.

Restructuring and impairment costs amounted to CHF 87 million. However, the favorable development of the operating result could more than offset the restructuring costs. Hence Clariant reported a net profit of CHF 25 million for the quarter, compared to a net loss of CHF 61 million a year ago.

As a consequence of the pick-up in business activity, inventories and trade receivables were significantly higher than in the second quarter of 2009 that had marked the peak of the economic crisis. Nevertheless cash flow from operations remained positive at CHF 33 million compared to CHF 184 million in the second quarter of previous year based on decisive net working capital management and good EBIT generation.

The company's cash position - including an investment of CHF 382 million in short-term deposits - remained strong at CHF 1'221 million.

Clariant continued to reduce its net debt to CHF 379 million from CHF 545 million at the end of 2009. The gearing - net debt divided by equity - improved to 20%, compared to 29% by year-end 2009 and remained stable compared to the end of the first quarter 2010.

Outlook

Although demand will remain solid in the remainder of the year, Clariant expects a weaker second half-year as the global economy is expected to soften and the normal seasonality of its businesses returns in 2010. In addition, raw material costs are expected to rise further.

In the second half-year, Clariant will continue to focus on generating cash, decreasing costs and reducing complexity, which will result in an additional reduction of job positions. The ongoing restructuring program will be finalized by the end of the year and the company will be managed for profitable growth as of 2011. However some of the measures - in particular related to the GANO activities - will not be completely implemented before 2013.

Based on the good results in the first half of the year and the continuing restructuring efforts, Clariant aims for a high single digit sales growth in local currency and an EBIT margin before exceptionals of above 8% for the full year. The cash flow from operations will remain strong.

Clariant confirms its target of a sustainable, above-industry-average return on invested capital (ROIC) by the end of 2010.

Topics

Organizations

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

A new boost for the data highway - ETH Zurich spin-off relies on a new material that efficiently converts electrical signals into optical ones

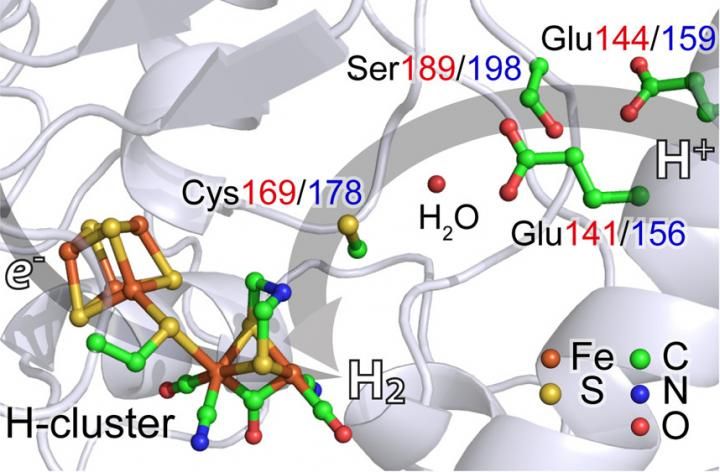

New X-ray spectroscopy explores hydrogen-generating catalyst

Walk like a … gecko? - Animal footpads inspire a polymer that sticks to ice

BASF invests in a new cyclododecanone plant

Physicists uncover new competing state of matter in superconducting material

BASF to establish STYROLUTION - Existing BASF styrenics activities to be transferred to separate companies

Clariant grows sales and improves underlying profitability

Scientists in Spain Develop a Panel of Genetic Markers for Tracing Meat from Farm to Fork - Researchers collaborate with Applied Biosystems to validate specific genetic polymorphisms for identifying individual pigs from commercial breeds