Historic Acquisition by Polish Company in the US

Qemetica Enters Agreement to Acquire Silicas Products Business for USD 310 Million from American PPG

Advertisement

Qemetica has signed an agreement with American corporation PPG to purchase its silicas products business for near PLN 1.2 billion (USD 310 million). The Polish chemical group will acquire certain assets of PPG and an operating subsidiary of PPG, which results in the acquisition of two factories (in the US and the Netherlands) and in gaining the right to conduct manufacturing and R&D activities in two additional US locations. PPG’s silica products business manufactures and supplies precipitated silica products to major companies around the world as performance-enhancing additives. Precipitated silica is a raw material essential in the production of “green” tires, batteries, fillers, characterized by stable growth and positive outlook. The acquisition of the silica business will increase Qemetica group's revenue and EBITDA, as well as diversify the group's product range and geographical operations. This acquisition is one of the largest transactions of this type carried out by a Polish company in the US.

The closing of the transaction contemplated by the agreement is expected to occur in the fourth quarter of 2024, subject to customary closing conditions (including approvals from antitrust authorities). The process of obtaining these approvals may take several months. This transaction is part of Qemetica's broader growth strategy. This past spring, Qemetica identified potential acquisitions as a direction for strengthening the group and seeking new growth engines when announcing plans for 2024-2029.

"In preparing for growth through acquisition, we defined the criteria for entering into discussions with potential sellers. We were looking for a business in which we could add value, invest and grow, based in the US, with a 100% or controlling stake, extending our value chain. This transaction, meeting all the mentioned criteria, means that after finalizing and fully integrating the new business, we will be closer to achieving our strategic goals: to develop sources of growth other than soda ash, to achieve geographic and product diversification and to significantly expand our global footprint with revenues from new markets" says Kamil Majczak, CEO of Qemetica.

Qemetica's New, Eighth Business

The transaction includes PPG’s precipitated silicas manufacturing facilities in Lake Charles, Louisiana, and Delfzijl, The Netherlands. In addition, QEMETICA will lease silicas manufacturing and research and development operations at PPG sites in Barberton, Ohio and Monroeville, Pennsylvania, respectively. The silicas products business is led by about 400 employees.

The production and sale of precipitated silica will be Qemetica's eighth business. The new precipitated silica business will become the group's second-largest in terms of revenue. Within the group, each of the eight businesses operates independently, maintaining their individual responsibility for production, sales, and logistics of their own operations. Qemetica's strategy for 2024-2029 aims to increase the independence of each of the individual businesses.

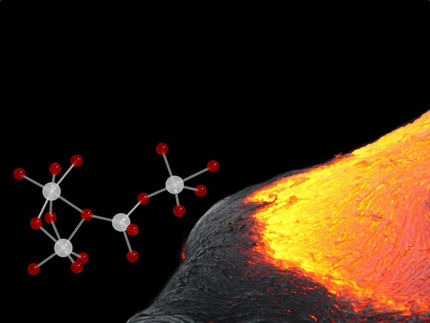

Expanding the group's asset portfolio with a silica producer extends the value chain, as Qemetica is currently one of Europe's largest suppliers of silicates – a raw material necessary for silica production. At the same time, silicates are made from soda ash, of which Qemetica is one of the leading producers in the European Union.

The transaction is also an example of vertical integration, where one entity manages various stages of the production chain. As a result of this acquisition, Qemetica will be able to offer more specialized chemicals (precipitated silica) used by blue chip customers to manufacture end products such as modern “green” tires.

"Incorporating the acquired entity will allow us to diversify our product range and expand into new geographic markets. It will also be a step towards a more even distribution of revenue and profit sources within the Group. The precipitated silica business will become the second largest, and the share of revenue generated in North America will exceed 10%, while the share of revenue from Poland will drop below 40%. This is an important step in building a global chemical group with Polish roots," says Marcin Puziak, CFO of Qemetica.