Patent filings in 3D printing grew eight times faster than average of all technologies in last decade

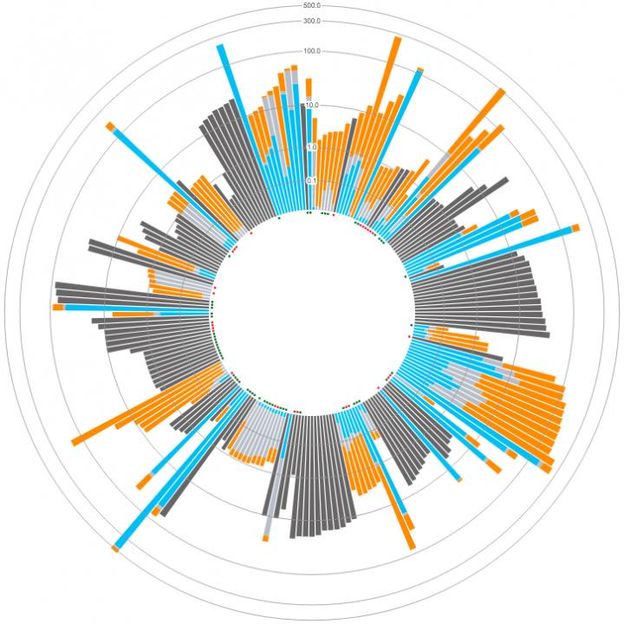

A report published by the European Patent Office (EPO) shows that innovation in additive manufacturing, also known as 3D printing, has surged in the past decade. The study, Innovation trends in additive manufacturing, finds that between 2013 and 2020, international patent families in 3D printing technologies grew at an average annual rate of 26.3% – nearly eight times faster than for all technology fields combined in the same period (3.3%).

The 3D printing market has also become more diverse. While previously the main players were established engineering companies, there are now also many start-ups and specialised additive manufacturing companies emerging. In total more than 50 000 international patent families (IPFs) for 3D printing technologies have been filed worldwide since 2001. An IPF represents a significant invention for which patent applications have been filed for two or more countries worldwide.

“With this study, we’re taking a global perspective on the 3D printing revolution using international patent data to report on the scope and implications of this technology trend,” says EPO President António Campinos. “Europe secured four of the top ten spots for research institutions in additive manufacturing innovation. This bodes well for the future since technical progress in this field often stems from the cutting-edge research in these institutions.”

US, European, and Japanese companies at the forefront

Europe and the US are leading the global race for 3D printing innovation. The US holds the top spot, with 39.8% of all IPFs related to additive manufacturing between 2001 and 2020. Europe (39 EPO member states) closely follows with a 32.9% share. Together, these regions account for nearly three-quarters of worldwide 3D printing innovation. Japan accounts for 13.9% of all 3D printing IPFs, and China and South Korea for 3.7% and 3.1% respectively. Within Europe, Germany has emerged as the clear leader, accounting for 41% of Europe's share, while France is in second place with 12%.

US, European, and Japanese companies all feature in the top 20 additive manufacturing patent applicants, with the leading three being General Electric, Raytheon Technologies and HP. Siemens, in fourth position, is Europe's strongest player, with almost 1 000 IPFs. Although the list of top companies is dominated by large engineering companies in a range of sectors, the additive manufacturing innovation ecosystem consists of several specialised 3D printing companies and a vibrant start-up scene as evidenced by the variety of smaller entities seen in the EPO's statistics.

The role of research

Universities and public research organisations (PROs) also contribute significantly to 3D printing innovation. Approximately 12% of 3D printing IPFs were filed by universities or PROs, which is nearly double their typical share (7%). Every third IPF associated with biomaterial developments and every second IPF for 3D printing of organs and artificial tissue originates from a university or PRO.

Among the top ten universities, PROs or hospitals, five are located in the US. But the clear leader is Germany's Fraunhofer Gesellschaft, with 221 IPFs. The Taiwanese ITRI is the only Asian organisation to make it into the top 10, which also includes two French research institutes (CNRS and CEA) and the Dutch TNO.

Disrupting an increasing variety of industry sectors

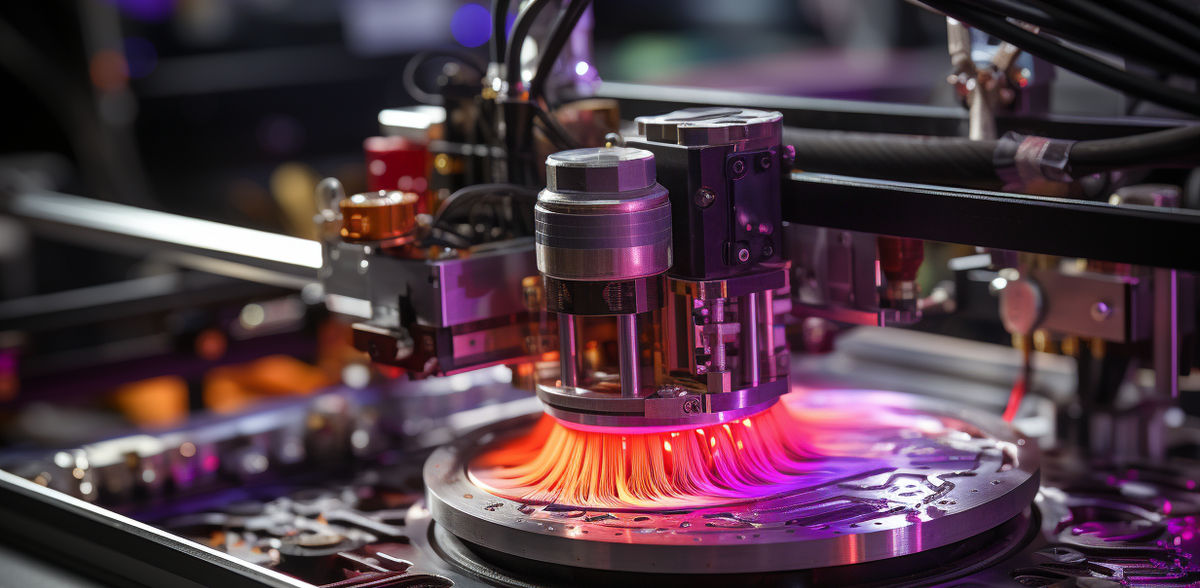

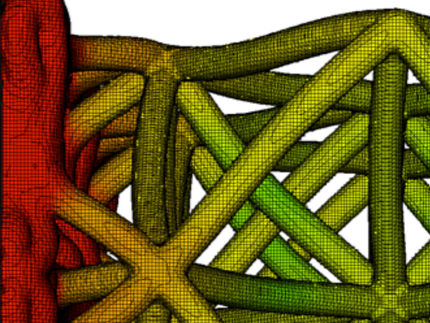

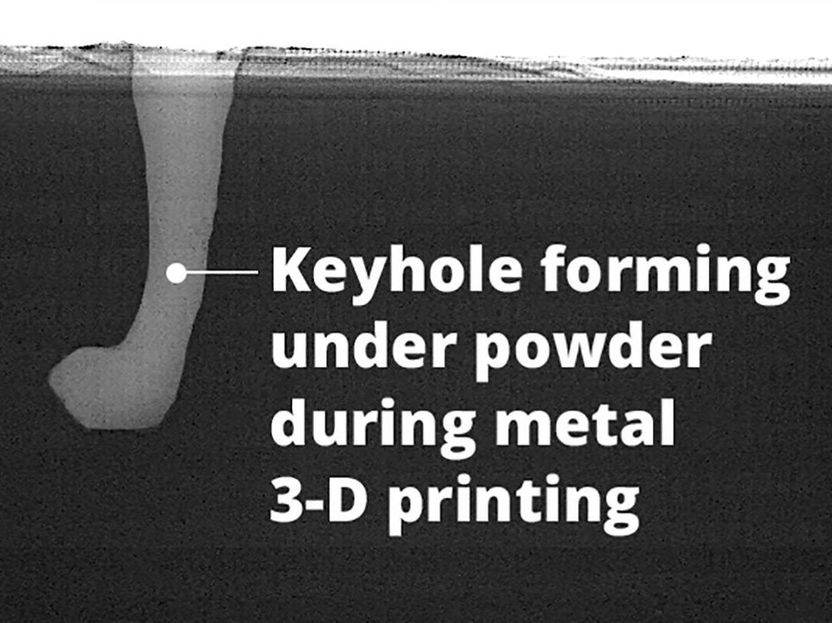

Additive manufacturing removes traditional technical restrictions to the industrial production process, reduces waste and paves the way for mass customisation. No longer a niche technology, it is transforming manufacturing in ever more industries. Since 2010, the health, medical and transportation sectors have attracted most of the 3D printing applications. However, as 3D printing technology develops for a growing variety of materials, such as plastics, metals, ceramics, and even organic cells, rapid growth of additive manufacturing applications has also been observed in tooling, energy, fashion, electronics, construction, and even the food sector.

Roughly one-fifth of all IPFs published between 2001 and 2020 are in the health and medical sector (total of 10 000 IPFs). Additive manufacturing is particularly suited to patient-specific implants and anatomical models. The higher-than-average presence of universities, PROs and hospitals amongst patent applicants is largely explained by the advances in medical applications for 3D printing. In transport, the second-biggest sector, additive manufacturing can be used to improve product development and serial production with more than 7 000 IPFs registered in the past decade.

The EPO's research, based on patent data, offers early insights into 3D printing’s potential future uses. Because patents are filed months or even years before any products appear on the market, patent information can signal the direction technologies are taking. This report shows how vital 3D printing is to fostering innovation and sustainability across sectors around the world. It follows the publication of the EPO’s first report on patents and 3D printing in July 2020, which focused exclusively on European patents.

The additive manufacturing market has experienced strong growth, with industry revenue tripling from USD 6 billion in 2016 to USD 18 billion (EUR 16.17 billion) in 2022, according to estimates from Wohlers Associates. During the pandemic, 3D printing played a pivotal role in the switch to local production, reducing dependence on international supply chains. Projections suggest the market could exceed USD 50 billion by 2028.