Lack of funding inhibits chemical start-ups - and thus climate protection

Advertisement

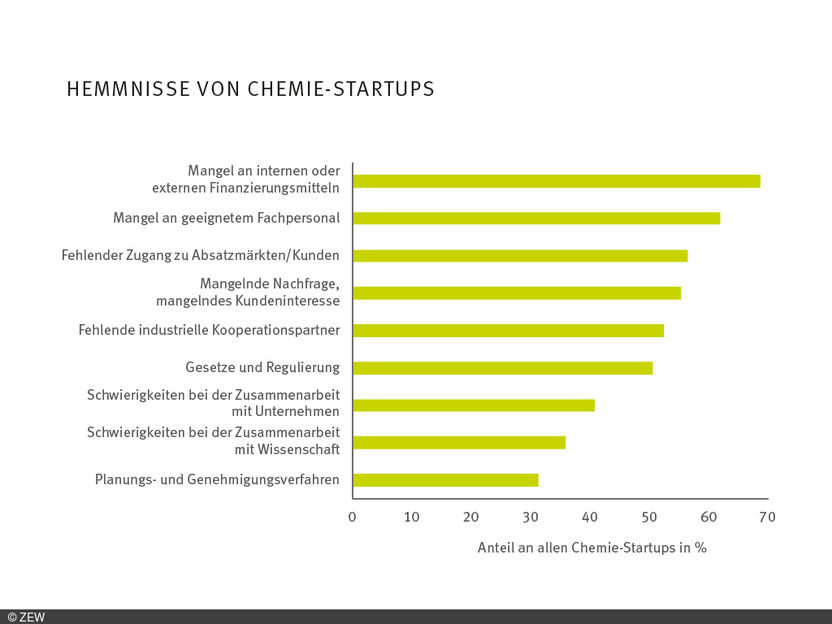

Chemical start-ups can make important contributions to the ecological transformation of the economy. They develop processes to make industrial production more sustainable and find climate-friendly ways to generate energy. However, the growth potential of chemical start-ups is currently not being fully exploited: There is a lack of sufficient funding. A recent study by ZEW Mannheim on behalf of the German Chemical Industry Association (VCI) shows that growth financing via venture capital in particular needs new impetus.

© ZEW

The ZEW study found that around two-thirds of chemical start-ups lack funding. Venture capitalists (VC) are particularly reluctant to invest in this sector: measured against total VC investments in start-ups in Germany, only 0.2 percent go to start-ups in the chemical industry. According to Dr. Christian Rammer, scientist in the ZEW research area "Innovation Economics and Business Dynamics" and author of the study, this is due to peculiarities of the industry: "Chemical start-ups have long investment phases of five to ten years, and the investment funds of often more than one million euros per start-up are also higher than in other industries. In addition, there are limited exit options as well as target markets in which companies are often already active and thus usually offer only limited short-term growth prospects."

Of the total VC investments, the lion's share goes to the IT and biotechnology sectors, which differ from chemical startups primarily in the level of investment costs. In order to be able to produce prototypes or laboratory applications, even on a large scale, chemical start-ups often need expensive technical equipment and highly qualified employees. In addition, there are high regulatory requirements for the approval of plants and products.

Gerd Romanowski, VCI Managing Director Science, Technology and Environment, says: "Planning and approval procedures also hinder the work of young high-tech companies. For every third chemical start-up, approval processes are an obstacle. Above all, lengthy procedures and the high administrative costs of applications and documentation are a burden on chemical start-ups."

Many chemical startups advance sustainability

However, chemical start-ups in particular are dedicated to future topics such as sustainability, climate protection and the energy transition: For more than a third of the industry start-ups, ecological issues are central to their business model. In addition, just under half offer individual sustainable products and services or are working on implementing some. Start-ups are unable to fully exploit their growth potential against a backdrop of financial scarcity. One consequence is that the high demand for climate-friendly solutions cannot be met.

According to the study, several starting points make sense in order to improve growth financing for chemical startups: "The startup strategy of the German Federal Ministry of Economics and Climate Protection must take into account in the state VC financing instruments that chemical startups face a more challenging starting situation than young companies in other industries. These are, in particular, high financing requirements and greater regulation, as well as generally long investment periods. Start-ups are therefore often unattractive to typical start-up financiers," says Christian Rammer. "But successful climate protection must also be driven by long-term investments in markets with growth prospects." Romanowski adds, "Barriers to innovation resulting from complex regulation, costly approval and licensing procedures must be reduced as far as possible, especially when it comes to innovative products and processes that we urgently need for climate and resource protection in our society."

Note: This article has been translated using a computer system without human intervention. LUMITOS offers these automatic translations to present a wider range of current news. Since this article has been translated with automatic translation, it is possible that it contains errors in vocabulary, syntax or grammar. The original article in German can be found here.