BASF resolves on share buyback program with a volume of up to €3 billion

Repurchased shares to be cancelled, reducing the share capital accordingly

In light of the positive business development and the divestitures in the course of 2021, the Board of Executive Directors of BASF SE has resolved on a share buyback program. The program amounts to up to €3 billion, shall start in January 2022 and be concluded by December 31, 2023, at the latest, subject to a renewed authorization to repurchase own shares by the Annual Shareholders’ Meeting of BASF SE on April 29, 2022. BASF SE will cancel all repurchased shares and reduce the share capital accordingly.

The share buyback program is based on the authorization by the Annual Shareholders’ Meeting of BASF SE on May 12, 2017 authorizing the Board of Executive Directors to purchase up to 10 percent of the issued shares at the time of the resolution (10 percent of the company’s share capital) until May 11, 2022. BASF plans to propose to the 2022 Annual Shareholders’ Meeting a renewed authorization to buy back own shares. The purchase shall be executed on the electronic trading platform of the Frankfurt Stock Exchange (Xetra) and be conducted making use of the safe-harbor exemption for buyback programs of Article 5 EU Market Abuse Regulation (MAR).

BASF remains committed to its progressive dividend policy. Share buybacks are another tool that BASF will use additionally to create value for its shareholders. Through the share buyback available capital will be returned to shareholders, the company’s capital structure optimized and earnings per share increased. BASF will continue to prioritize organic growth in its use of capital, while acquisitions are currently of lower relevance for the company.

Based on the strength of its balance sheet and the company’s ability to consistently deliver high free cash flows, BASF continues to strive to maintain a solid A rating. BASF currently has a rating of A/A-1/outlook stable from Standard & Poor’s and A3/P-2/outlook stable from Moody’s. Fitch currently assigns a rating for BASF of A/F1/outlook stable.

From 1999 to 2008, BASF repurchased shares for around €9.9 billion and reduced the number of outstanding shares by in total around 29 percent.

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

Shear_modulus

Laplace_principle_(large_deviations_theory)

Bunching_parameter

CAMSIZER X2 | Dynamic image analyzers | Verder

Lamellar_vector_field

Prandtl-Meyer_function

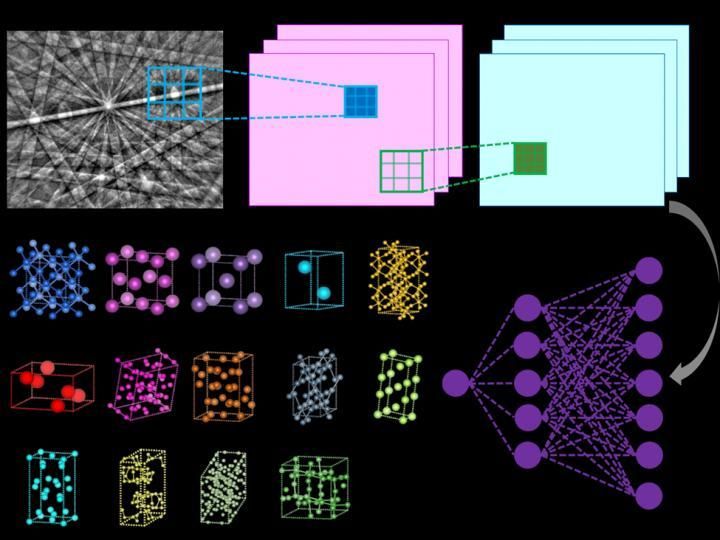

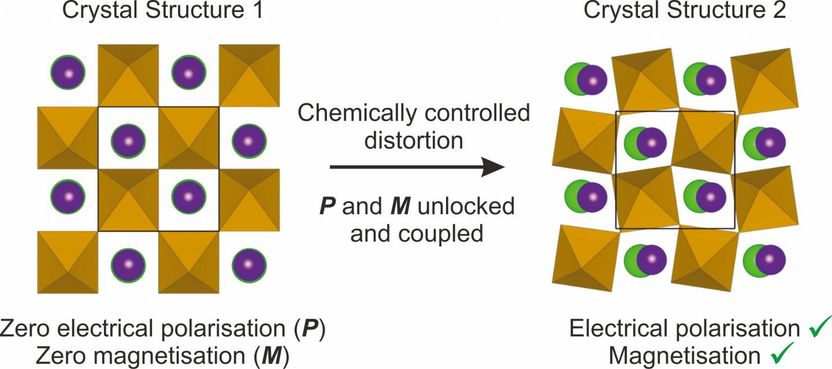

Chemists control structure to unlock magnetization and polarization simultaneously

Fractional_quantum_Hall_effect

Plasma_parameter

Free_entropy

GHK_current_equation