Evonik is back on course for growth

Evonik has achieved the financial targets it set itself in May 2020. Production and logistics have been secured worldwide and all measures to protect the workforce have been consistently implemented. For 2021 the company is back on course for growth.

Symbolic image

pixabay.com

"We passed the pandemic endurance test," said Christian Kullmann, chairman of the board of management. "We have successfully overcome the crisis and we have delivered."

In the spring of 2020 Evonik was one of the few companies to give an outlook for the full year. With adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of €1.91 billion and sales of €12.2 billion, the target was fully met. Adjusted EBITDA decreased by 11 percent compared with the previous year, while earnings from the three growth divisions Specialty Additives, Nutrition & Care and Smart Materials fell by only 3 percent. These three divisions now account for about 95 percent of the operating business’ earnings. In the previous year, Evonik posted an adjusted EBITDA of €2.15 billion and sales of €13.1 billion.

"In the crisis, our transformation towards more specialty chemicals has paid off," said Kullmann. "We are in the midst of this transformation process, which we will continue to drive forward, and which will generate new growth in 2021 and beyond."

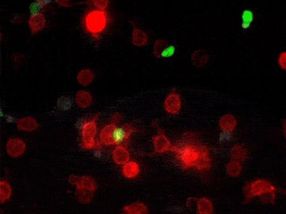

Growth projects include the expansion of specialty lipids production, which are essential for mRNA-based Covid-19 vaccines. In addition to production in the USA and Canada, Evonik is further expanding its production facilities at the German sites of Hanau and Dossenheim, which are expected to produce lipids in commercial quantities as early as the second half of 2021. Evonik’s new production complex for Polyamide 12, used in growth markets such as 3D printing, will also be ready this year as planned.

Today Evonik generates around 35 percent of its sales from products that, compared with competing products, offer superior sustainability benefits to customers. In the field of future technologies, these so-called Next Generation Solutions are urgently needed. Evonik will continue to increase the proportion of sales from these products in the coming years.

For 2021 Evonik expects adjusted EBITDA to rise to between €2.0 billion and €2.3 billion. Sales are expected to be between €12 billion and €14 billion and the cash conversion rate at around 40 percent. In the first quarter of this year the company expects adjusted EBITDA of at least €550 million.

Last year Evonik increased its free cash flow to €780 million and the cash conversion rate to above 40 percent. "We raised our forecast for free cash flow twice during the year and then even exceeded that," said Ute Wolf, chief financial officer. "Our outlook points in a clear direction: We expect rising earnings, a persistently high cash conversion rate and thus an increase in free cash flow in 2021."

Net income for the year 2020 fell to €465 million. In 2019, it amounted to €2.1 billion, a figure that included the proceeds from the sale of the Methacrylates business.

Evonik believes in continuity for the dividend. At the annual shareholders’ meeting on June 2, 2021, the executive and supervisory boards will be proposing a dividend of €1.15 per share. Based on the closing share price at year-end 2020 that corresponds to a dividend yield of 4.3 percent.

Development of the divisions

Specialty Additives: The division's sales fell by 5 percent to €3.23 billion in 2020. Demand for additives for the automotive and coating industries initially declined significantly due to the challenging economic situation but showed a clear recovery at the end of the year. In contrast, additives for products in the construction industry and renewable energies experienced robust demand throughout the year. Demand for durable goods also recovered after a decline at the beginning of the year. The additives for polyurethane foams, used for example in mattresses or refrigerators, were able to benefit from this. Adjusted EBITDA decreased by 3 percent to €857 million.

Nutrition & Care: Sales at Nutrition & Care rose 2 percent to €2.99 billion in 2020. At Animal Nutrition, essential amino acids generated higher sales than in the previous year. In the methionine business, sales volumes increased with higher demand worldwide. Overall, sales prices were stable in the second half of the year. Demand for products from the health and care industries was also pleasing. Active Ingredients for cosmetic applications as well as pharmaceutical polymers in particular showed a positive development. Adjusted EBITDA rose by 21 percent to €560 million, mainly due to improved selling prices and successful cost management.

Smart Materials: The division's sales fell 4 percent to €3.24 billion in 2020. Business was particularly affected by the global economic slowdown in the second and third quarters but was able to return to the previous year's level in the fourth quarter. Overall, however, this led to a noticeable decrease in volumes. In the area of polymers, this was particularly the case for high-performance plastics for the automotive sector. The same applies in the field of inorganics for silica, which are used in the tire industry. Demand was significantly more robust for hygiene and care products as well as for environmental applications. The strong earnings contribution from PeroxyChem, which was included for the first time, had a positive effect. Adjusted EBITDA decreased by 19 percent to €529 million.

Performance Materials: The division's revenue fell 25 percent to €1.98 billion in 2020. Sales of C4-Verbund products decreased as a result of declining demand, particularly from the automotive and fuel industries. In the business with superabsorbents, the improving but still below-average capacity utilization in the industry had a negative impact. Adjusted EBITDA decreased by 65 percent to €88 million.