Merck Well-Positioned for Further Growth

From today’s perspective targeted smaller to medium-sized acquisitions after 2022 more likely than major transformative deals

Merck expects to deliver continued profitable growth in the coming years despite a challenging market environment. Today at its virtual Capital Markets Day, the company presented to analysts and investors the progress made in realizing the growth and expansion phase of its strategy for the period until 2022.

Merck KGaA

“Our ambition is clear: We want to be the vibrant science and technology company. We have made significant progress on this journey in recent years,” explained Stefan Oschmann, Chairman of the Executive Board and CEO of Merck. “In recent months, the strengths of our business model with three innovation-driven business sectors have become particularly evident during the Covid-19 crisis,” said Oschmann. As previously reported, Merck expects slight to moderate organic growth of net sales and EBITDA pre in 2020. The company continues to expect Group sales of between € 16.9 billion and € 17.7 billion as well as EBITDA pre in a range of € 4.45 billion to € 4.85 billion.

Good progress in all business sectors

All three business sectors of Merck have moved forward in delivering on their strategic priorities in recent years. Healthcare has seen increasing sales contributions from the medicines Bavencio and Mavenclad and has made good progress with its development pipeline. The Life Science business sector continues to deliver above-market growth and has been operating more profitably than most of its competitors. With the acquisition of Versum Materials, Performance Materials has shifted its portfolio to focus on the high-growth semiconductor business and has generated high margins. “The transformation of Merck in recent years and our clear focus on science and technology have paid off. All our business sectors operate in highly attractive markets. That’s why this company has excellent prospects for the future,” said Oschmann. “Our Healthcare pipeline, our Process Solutions business with products and services for drug manufacturing and our Semiconductor Solutions business will be the main growth drivers of Merck in the coming years.” Merck will continue to stand for steady earnings growth, high margins and a low risk profile, Oschmann added.

Following the Versum acquisition last year, Merck is giving priority to organic growth while rapidly lowering its debt and pursuing a sustainable culture of cost consciousness in the period until 2022. In addition, the company announced a further development of its portfolio strategy. “We don't rule out large transformative deals as of 2022, yet in view of our strong business portfolio, at present the likelihood is higher that we will complement our businesses through a number of smaller to medium-sized acquisitions after 2022,” said Oschmann.

Healthcare confirms its target of around € 2 billion for 2022 – and sees even further potential

For the Healthcare business sector, Merck underscored its ambition to achieve around € 2 billion in sales from its pipeline by 2022. In view of highly promising development projects, Merck also sees further significant growth potential beyond 2022. The company expect sales performance in its core business to remain at least stable through to 2022.

In recent years, Healthcare has accelerated its organic growth, with increasing contributions from Mavenclad and Bavencio. Used to treat certain forms of multiple sclerosis, Mavenclad has already been approved in 80 countries, including the United States. In spring, the market environment for Mavenclad was temporarily heavily impacted by the Covid-19 crisis. However, signs of recovery emerged in June.

On June 30, the U.S. Food and Drug Administration (FDA) approved the immuno-oncology medicine Bavencio for the maintenance treatment of patients with locally advanced or metastatic urothelial carcinoma (UC) that has not progressed with first-line platinum-containing chemotherapy. Just a few days earlier, on June 22, Merck announced that the European Medicines Agency (EMA) had validated and accepted for review the Type II variation application for Bavencio for first-line maintenance treatment of patients with locally advanced or metastatic UC.

In March, the Japanese Ministry of Health, Labour and Welfare (MHLW) approved the oncology drug tepotinib for the treatment of patients with unresectable, advanced or recurrent non-small cell lung cancer (NSCLC) with METex14 skipping alterations. Moreover, on August 25 Merck announced that the FDA had accepted and granted Priority Review to the New Drug Application for tepotinib for the treatment of adult patients with metastatic NSCLC.

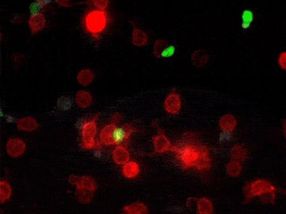

Merck is making excellent progress with its development pipeline. In May, positive results from the Phase II open-label extension study were presented on the long-term efficacy and safety profile of investigational evobrutinib in adult patients with relapsing multiple sclerosis. In June, the MHLW granted SAKIGAKE ’fast-track’ designation for the investigational bifunctional fusion protein bintrafusp alfa as a potential treatment for patients with biliary tract cancer. Merck is currently investigating bintrafusp alfa in multiple clinical trials.

Life Science is poised to deliver above-market growth

For the Life Science business sector, Merck expects average annual organic sales growth of 6% to 9% in the medium term, significantly above the expected growth of the life science industry of 5% to 6%. For the three Life Science business units, namely Process Solutions, Applied Solutions and Research Solutions, the company expects organic growth to be stronger than that of the respective market. In the coming years, the margin of Life Science is also likely to be significantly higher than the market average. This above-market growth is based on an advantageous portfolio as well as continued very favorable business performance.

The Process Solutions business unit, which markets products and services for the entire pharmaceutical production value chain, is likely to remain the key driver of sales growth within Life Science. For Process Solutions, Merck expects annual organic sales growth in the low teens percentage range in the coming years. The business is benefiting from strong growth of the market for biopharmaceuticals, the increasing number of active pharmaceutical ingredients as well as the rapid growth of new therapeutic approaches such as gene and cell therapies. In April, Merck announced plans to expand its site in Carlsbad, California, USA, by adding a second viral vector facility to support viral and gene therapy manufacturing. In September, the company announced plans to expand its facility near Madison, Wisconsin, USA, where it manufactures antibody-drug conjugates.

Merck expects annual organic sales growth in the low single-digit percentage range in the coming years in its Research Solutions business unit, which provides products and services to support life science research for pharmaceutical, biotechnology and academic research laboratories. In the coming years, the business should benefit from increasing research activities in the biotech sector, among other things. For the Applied Solutions business unit, which offers a broad range of products for researchers as well as industrial and scientific laboratories, Merck expects annual organic sales growth in the mid single-digit percentage range for the coming years, among other things thanks to higher demand for testing in many fields, for example food safety.

Performance Materials realizing synergies faster than expected

With the acquisition of Versum, the Performance Materials business sector achieved a key milestone in its Bright Future transformation program last year. Merck is making good progress with the integration of Versum. The company confirms the cost synergy target of € 75 million as of 2022 and expects faster realization this year, along with additional sales synergies as of next year.

The business portfolio is now clearly targeted to the electronic materials field. In the first half of 2020, the Semiconductor Solutions business unit already accounted for 56% of Performance Materials net sales. Against this background, for the Performance Materials business sector Merck expects average annual organic sales growth of 3% to 4% along with an EBITDA pre margin of around 30% in the medium term.

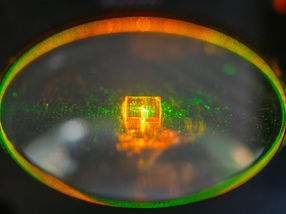

For Semiconductor Solutions, Merck expects annual organic sales growth in the mid to high single-digit percentage range in the coming years. Semiconductor Solutions is thus expected to be the fastest-growing business unit of Performance Materials. In addition to the expected market growth, the business unit should benefit from its favorable product and service portfolio as well as from the synergies arising from the Versum integration.

In view of the continuing price pressure in the Liquid Crystals business, Merck expects an annual organic decline in sales in the low single-digit percentage range for the Display Solutions business unit in the coming years. Display Solutions comprises the business with liquid crystal and OLED materials, photoresists and liquid crystal windows. By contrast, the company foresees annual sales growth in the low single-digit percentage range for its Surface Solutions business unit in the coming years. Surface Solutions offers functional and decorative solutions for automotive coatings, cosmetics and industrial applications.