Evonik acquires Porocel for US$210 million to accelerate growth of catalysts business

Acquisition gives Evonik access to catalyst rejuvenation technology and to available production capacity

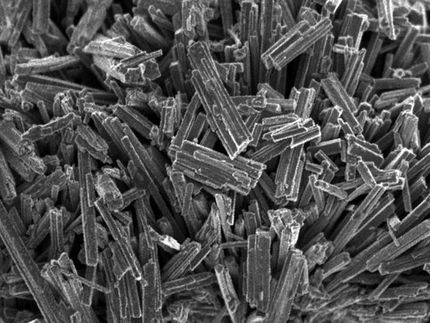

Evonik is acquiring the Porocel Group for US$210 million to accelerate the growth of its catalysts business. Based in Houston, Texas, Porocel offers a technology for highly efficient rejuvenation of desulfurization catalysts, which are in increasing demand to produce low-sulfur fuel. Rejuvenation reduces carbon-dioxide emissions by more than 50 percent compared with the production of new desulfurization catalysts. In addition, Porocel has available production capacity, enabling Evonik to speed up expansion of its existing business with fixed-bed catalysts.

Evonik

“This acquisition is the next logical step in the strategic development of our portfolio. Our focus is on stable and high-margin specialty chemicals,” said Christian Kullmann, chairman of the executive board. “We are systematically expanding the share of our specialty businesses – and that at an attractive valuation.”

The purchase price (enterprise value) is 9.1 times adjusted earnings before interest, tax, depreciation and amortization (EBITDA) in 2019, which is an attractive valuation for a high-quality asset in the catalyst sector. The transaction is expected to close by the end of 2020 and is subject to approval by the relevant authorities.

Porocel generated sales of approximately US$100 million and EBITDA of about US$23 million in 2019. The EBITDA margin at around 23 percent is above Evonik's target range of 18-20 percent. Porocel has increased its EBITDA significantly in the last three years, driven by new product development through an expansion of research and development capabilities. The company has more than 300 employees worldwide and production facilities in the USA, Canada, Luxembourg, and Singapore.

Porocel’s global position strengthens the worldwide presence of Evonik's catalyst activities. The complementary fit to Evonik’s existing catalyst portfolio and especially the available production capacities offer considerable growth opportunities. Evonik expects to increase sales of the combined catalyst business to significantly more than €500 million by the end of 2025 without the need for investment in new capacities.

Catalysts are essential for the production of many chemical products and for production of clean fuels. The market is characterized by a broad spectrum of applications and robust growth of around 4 percent with low cyclicality.

Porocel technology drives sustainability

“Sustainability and especially circular economy play a decisive role for us when it comes to acquisitions and the orientation of our portfolio,” said Claus Rettig, head of the Smart Materials division. “With the acquisition of Porocel we are meeting increasing demand that is coming from a trend towards sulfur-free fuels as well as reducing CO2 emissions and saving resources. The catalyst rejuvenation process results in significantly less CO2 emissions than the manufacture of fresh catalysts, while yielding comparable efficiency and at a much lower cost.”

The acquisition gives Evonik access to major customers in the refinery and petrochemicals sector. Porocel's core competence is an efficient technology for purification adsorbents, sulfur recovery catalysts and hydroprocessing services highlighted by rejuvenation of used desulfurization catalysts.

“Our innovation power driven by the talented team at Porocel is well suited to Evonik’s culture and we look forward to grow the business further together,” said Terence McHugh, president and chief operating officer of Porocel.

The transaction will be financed out of Evonik's strong cash position.

Most read news

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.