BASF aims to grow above market: Asia Pacific sales to double by 2020

Headcount to increase by at least 5,000

BASF outlined its Strategy 2020 for Asia Pacific. Through 2020, BASF aims to grow on average two percentage points faster than the Asia Pacific chemical market each year. With expected market growth of 4 to 5 percent per year, this would double regional sales by 2020 while earning a premium on cost of capital.

This ambitious strategy is based on growth and new business initiatives. Under its new strategy, BASF will initially target five key growth industries in the region, will increase headcount by at least 5,000 from a current figure of approximately 15,000, and plans to generate 70 percent of regional sales from local production. At the same time, the company will invest €2 billion in the region between 2012 and 2013, and aims to create efficiency improvements that are expected to save at least €100 million annually by 2012.

“BASF has established its position as the leading chemical company owing to its long-standing commitment to the Asia Pacific region. The Asian growth markets will continue to provide attractive opportunities, and our Strategy 2020 will help us to realize them,” said Dr. Martin Brudermüller, member of the Board of Executive Directors of BASF SE, responsible for Asia Pacific. “The current economic situation does not change our positive expectations of the long-term potential of these dynamic markets.”

Investments of €2 billion between 2009 and 2013

To support the goal of producing 70 percent of its sales within the Asia Pacific region, BASF plans to invest €2 billion between 2009 and 2013. This amount includes BASF’s 50 percent share of the $1.4 billion expansion of its integrated chemical production joint venture in Nanjing, China, which was approved by the national government in July 2009. In Chongqing, China, BASF is in the planning phase for a 400,000 ton/year plant for MDI, a precursor for polyurethanes. BASF and the Chongqing authorities aim for mechanical completion of the plant by the end of 2013 and commercial operation by early 2014. Final approvals of the project by Chinese regulators are expected in 2009, and subsequently the BASF Board of Executive Directors plans to approve the investment in the first quarter of 2010.

Five key customer industries, new geographic markets

In Asia Pacific, BASF will organize its sales efforts around key industries in order to grow faster than the market. The company has established an initial set of industry target groups where it intends to become a preferred supplier, including the automotive, construction, packaging, paint and coatings, and pharmaceuticals industries. By looking closely at the value chains in these key industries, BASF will better understand its customers’ needs and will be better positioned to provide products and solutions based on BASF’s global knowledge and resources.

Already present in 15 countries in the region, with significant operations in China, Japan, Korea, Malaysia and India, BASF will also actively seek opportunities to support rapidly developing customer markets in relatively untapped locations, including Vietnam and inland China. Larger local team, enhanced R&D capabilities

To achieve its goals, BASF will implement an enhanced development plan to strengthen its existing local talent base. By 2020, BASF expects to increase its headcount in Asia Pacific by at least 5,000. In its two challenging growth markets, China and India, BASF has set up dedicated recruitment centers to manage the increase in hiring. The company will double the number of employees in research and development by 2020, especially at its two major R&D clusters in China and India. Currently, BASF has 300 employees working in R&D at 15 sites in Asia Pacific.

“Local innovation and local production are driving business growth in this region. We therefore want to develop new applications, products and solutions together with our customers in Asia, adapted for Asian needs, and then serve local markets primarily through our sites and our talent in the region,” continued Brudermüller.

Operating efficiencies with site optimization

BASF plans to reduce costs by at least €100 million annually by 2012, increasing the efficiency of its existing operations. An important aspect of this effort is the company’s Site Optimization Project, which aims to increase capacity through debottlenecking production and by exploiting technical synergies, for example in production processes or across sites. All measures implemented under this project are expected to recoup their costs within one year.

Site optimization in Asia Pacific is ongoing at the company’s integrated production sites in Kuantan, Malaysia, and Nanjing, China, as well as in Yeosu, Korea and other production sites in the region.

Other news from the department business & finance

These products might interest you

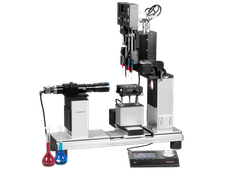

OCA 200 by DataPhysics

Using contact angle meter to comprehensively characterise wetting behaviour, solids, and liquids

With its intuitive software and as a modular system, the OCA 200 answers to all customers’ needs

Tailor-made products for specific applications by IPC Process Center

Granulates and pellets - we develop and manufacture the perfect solution for you

Agglomeration of powders, pelletising of powders and fluids, coating with melts and polymers

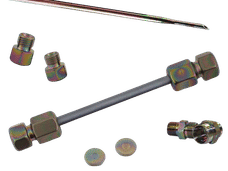

Dursan by SilcoTek

Innovative coating revolutionizes LC analysis

Stainless steel components with the performance of PEEK - inert, robust and cost-effective

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

Hugo Meding GmbH - Halver, Germany

Nobel Prize in Chemistry for 2009 for studies of the structure and function of the ribosome - The ribosome translates the DNA code into life

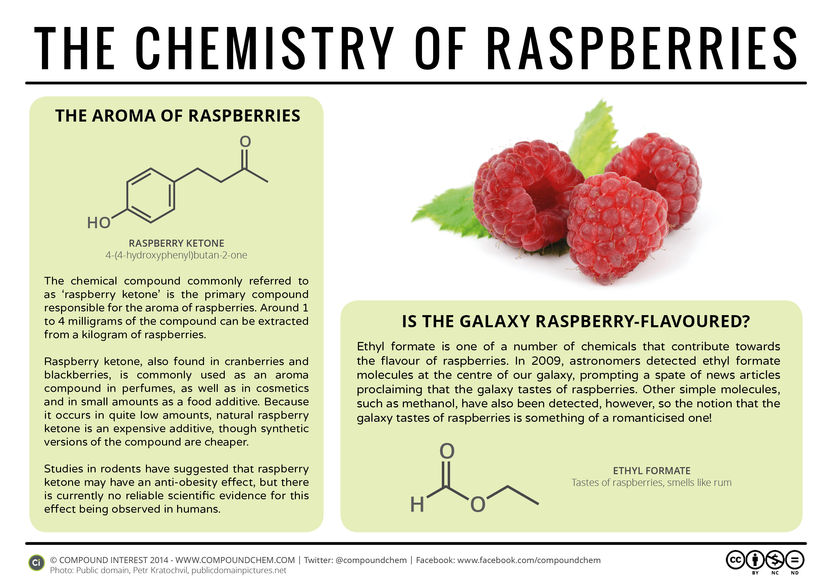

Raspberries, Weight Loss, & The Galaxy

Chemtura Completes Sale of Oleochemicals Business to PMC Group NA Inc.